Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

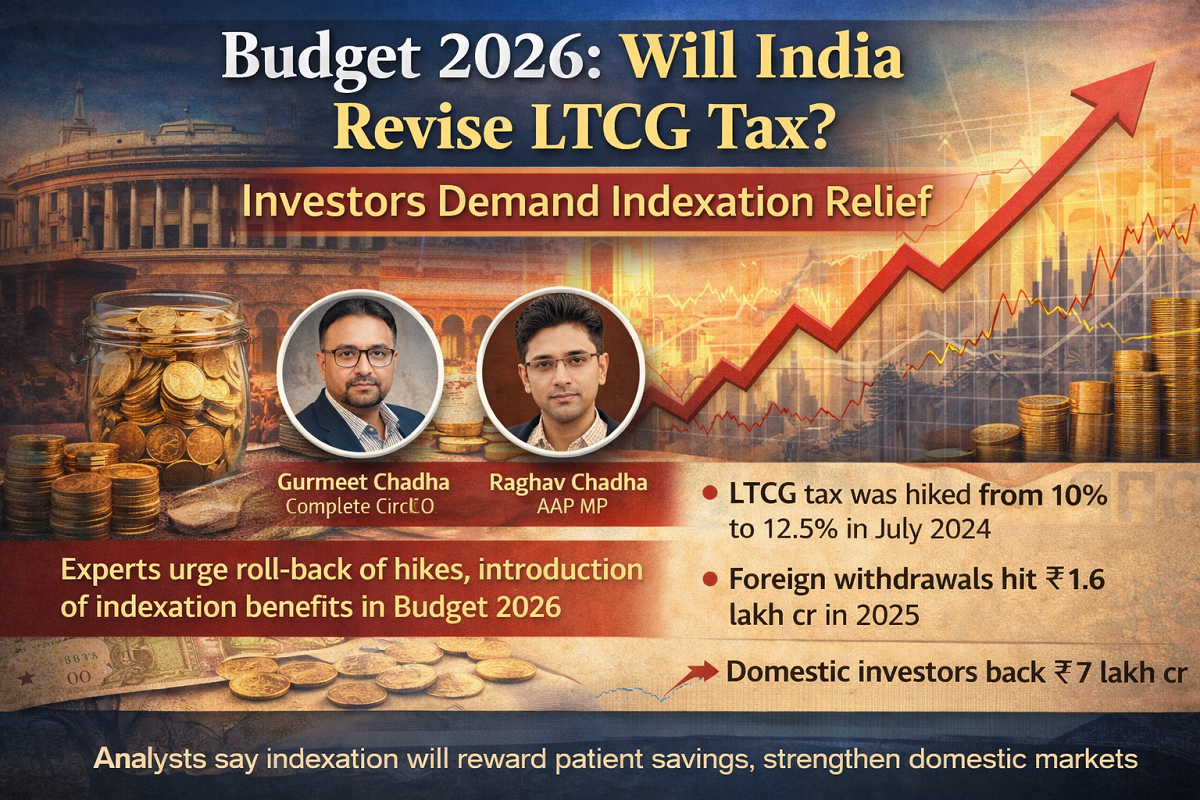

Domestic market voices and equity investors are urging the government to restore indexation benefits and ease long-term capital gains (LTCG) tax rules, arguing that the current regime discourages patient equity participation. They believe such reforms would reward long-term saving behaviour, deepen India’s capital markets, and strengthen resilience during foreign outflows—similar to 2025, when foreign portfolio investors pulled out nearly ₹1.6 lakh crore, but domestic investors still infused ₹7 lakh crore, stabilising markets.

The demand is being strongly led by corporate investors and policy influencers. Complete Circle CIO Gurmeet Chadha and AAP MP Raghav Chadha have both urged Finance Minister Nirmala Sitharaman to revisit India’s capital gains framework, saying the burden on genuine long-term investing is rising.

Gurmeet Chadha, in a recent post on X, highlighted an alarming data point: only around 30% of Systematic Investment Plans (SIPs) survive longer than three years. According to him, the system should encourage long-term equity capital rather than punish it. “Patient long-term risk capital must be rewarded. We need risk capital to fund India’s growth story,” he emphasised. His comments follow the increase in the LTCG tax rate from 10% to 12.5% in July 2024.

Raghav Chadha raised the issue in Parliament, arguing that India’s tax system currently treats long-term investing too harshly:

“There is no indexation. Surcharges are high. The rules keep changing. This is not how long-term investment should be treated.”

The argument becomes clearer with a simple illustration:

Two investors—A and B—put ₹5 lakh each into the same equity fund.

A holds for seven years and exits with ₹8 lakh

B sells after ten months, also making ₹8 lakh

Their gains are identical: ₹3 lakh each.

Under today’s rules:

A pays LTCG tax on ₹1.75 lakh (after the ₹1.25 lakh exemption), taxed at 12.5% = ₹21,875

B pays STCG tax on ₹3 lakh at 20% = ₹60,000

On the surface, A appears to benefit. But A gets no indexation benefit, meaning inflation over seven years—roughly 5% per annum—is ignored. A large portion of the seven-year return simply compensates for inflation, but tax is charged on the full nominal gain.

Add to this the fact that tax rates changed midway through A’s holding period. This, investors say, is exactly the “policy risk” the current system creates—and why India is losing out on patient capital.

Reintroduce indexation to tax only real gains

Reduce LTCG tax back to 10% or lower for long-term holdings

Rationalise STCG rates to support liquidity, but prioritise incentives for long-term investors

Supporters argue that reform would:

Reward patience

Strengthen equity culture

Increase domestic capital participation

Reduce dependence on foreign flows

Make India’s markets more shock-resistant

The debate around LTCG taxation is expected to intensify as Budget 2026 approaches, with policymakers, market experts, and investors watching closely to see if the government will respond to these demands.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)