Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

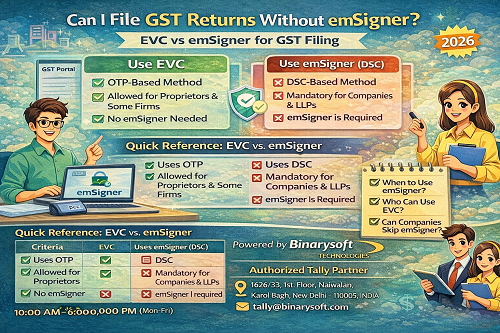

One of the most frequently asked questions by GST taxpayers, accountants, and business owners is:

“Can I file GST returns without emSigner?”

This confusion usually arises due to DSC errors, emSigner not running issues, or last-minute GST return filing pressure. Many users want to know whether GST returns can be filed without using emSigner and what alternatives are legally allowed.

This detailed guide explains:

This article is fully original, non-copyrighted, and suitable for direct copy-paste on websites, blogs, or training material.

emSigner is a digital signing utility used to authenticate GST filings using a Digital Signature Certificate (DSC).

It works as a background service that allows the GST portal, operated by Goods and Services Tax Network, to access your DSC securely.

emSigner is commonly used for:

✅ YES – In some cases

❌ NO – In other cases

Whether you can file GST returns without emSigner depends on:

Two Methods to File GST Returns

GST returns can be authenticated in two ways:

You can file GST returns without emSigner if you use EVC authentication.

EVC Is Allowed For:

How EVC Works:

�� In this case, emSigner is NOT required.

You must use emSigner if GST filing is done using DSC authentication.

emSigner Is Mandatory For:

For these entities, GST returns cannot be filed without emSigner.

|

Criteria |

emSigner (DSC) |

EVC |

|

Requires emSigner |

Yes |

No |

|

Uses DSC |

Yes |

No |

|

Uses OTP |

No |

Yes |

|

Mandatory for Companies |

Yes |

No |

|

Ease of Use |

Technical |

Simple |

|

Compliance Level |

Higher |

Standard |

Companies and LLPs are legally required to:

Hence, EVC is not allowed, and emSigner becomes compulsory.

However, companies cannot bypass emSigner, even in these cases.

❌ For Companies & LLPs – NO

✅ For Proprietors – YES (if allowed)

Only eligible taxpayers can switch authentication mode. Companies and LLPs cannot avoid emSigner legally.

Businesses using Tally for GST compliance often face emSigner issues during:

Tally is developed by Tally Solutions Pvt. Ltd. and works seamlessly with GST when emSigner is properly configured.

If emSigner is mandatory and not used:

✔ Start emSigner before filing

✔ Run emSigner as Administrator

✔ Ensure DSC token is connected

✔ Use supported browser

✔ Restart system if needed

✔ Avoid multiple emSigner versions

Most emSigner problems are technical, not legal. Professional support helps:

If you are facing confusion about filing GST returns without emSigner, or dealing with DSC, emSigner, or Tally-GST issues, Binarysoft Technologies provides expert assistance.

Why Binarysoft Technologies?

✔ Authorized Tally Partner

✔ GST & DSC expertise

✔ emSigner issue resolution

✔ Tally-GST integration support

✔ Reliable compliance guidance

Contact Details

Powered by Binarysoft Technologies

Authorized Tally Partner

�� Location:

1626/33, 1st Floor, Naiwalan,

Karol Bagh, New Delhi – 110005, INDIA

�� Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

�� Email:

tally@binarysoft.com

�� Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Q1. Can I file GST returns without emSigner?

Yes, only if you use EVC authentication and are eligible.

Q2. Is emSigner mandatory for companies?

Yes. Companies must use DSC via emSigner.

Q3. Do proprietors need emSigner?

No, proprietors can use EVC.

Q4. Can I avoid emSigner if it is not working?

No, if DSC is mandatory, emSigner cannot be bypassed.

Q5. Is emSigner required for all GST returns?

Only for DSC-based filings.

Q6. Does Tally require emSigner?

Tally itself does not, but GST filings through Tally may require emSigner.

Q7. Who can help with emSigner issues?

An Authorized Tally Partner like Binarysoft Technologies.

✔ You can file GST returns without emSigner only if EVC is allowed.

❌ Companies and LLPs cannot file GST returns without emSigner.

Understanding your authentication mode is critical to avoid delays and penalties.

For smooth GST filing, emSigner support, and expert Tally guidance, connect with Binarysoft Technologies – Authorized Tally Partner.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)