Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

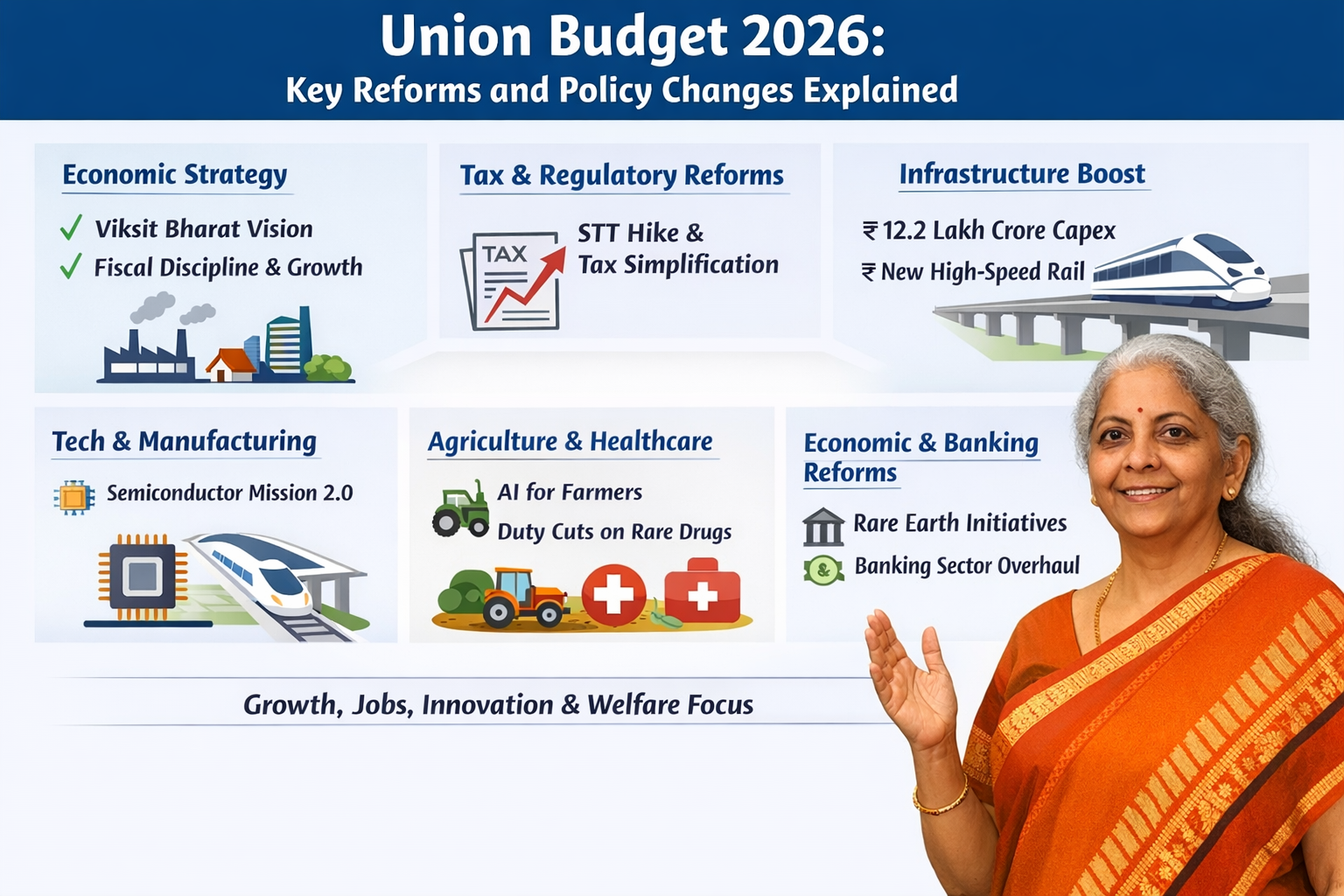

The Union Budget 2026 represents a continuation of India’s reform-driven growth strategy, focusing on strengthening economic fundamentals while addressing emerging global and domestic challenges. Rather than short-term relief measures alone, Budget 2026 emphasizes structural reforms, policy simplification, institutional strengthening, and long-term sustainability.

The reform agenda in this budget aims to improve ease of doing business, fiscal stability, investment climate, productivity, and inclusive development, ensuring India remains resilient and competitive in a rapidly evolving global economy.

Union Budget 2026 is guided by a long-term vision of:

Sustainable economic growth

Strong public finances

Private sector-led investment

Inclusive and balanced development

The reforms focus on creating systems rather than temporary incentives, enabling the economy to grow with stability and confidence.

Fiscal discipline remains a key reform priority. Budget 2026 emphasizes:

Rationalisation of government expenditure

Efficient allocation of public resources

Gradual fiscal consolidation

Improved transparency in budgeting

These measures strengthen investor confidence and ensure long-term macroeconomic stability.

Tax reforms under Budget 2026 aim to make the system simpler, more predictable, and less litigation-prone. Key reform directions include:

Simplification of tax compliance procedures

Increased use of digital and faceless assessments

Reduction in tax disputes through clarity in rules

Faster processing of refunds

Such reforms reduce the compliance burden on taxpayers and improve voluntary compliance.

To enhance ease of doing business, Budget 2026 focuses on:

Reducing regulatory overlap

Simplifying approvals and licenses

Promoting trust-based governance

Expanding digital single-window systems

These reforms allow businesses to focus more on growth and innovation rather than administrative hurdles.

A strong financial system is critical for reforms to succeed. Budget 2026 strengthens:

Banking sector stability

Credit flow to productive sectors

Risk management frameworks

Digital financial infrastructure

Reforms also encourage efficient capital allocation and improved access to finance for businesses and entrepreneurs.

MSME reforms remain central to Budget 2026, with a focus on:

Improving access to institutional credit

Strengthening credit guarantee mechanisms

Faster payment systems

Integration of MSMEs into formal and global value chains

These reforms help MSMEs scale up and become more competitive.

Union Budget 2026 supports employment-focused reforms by:

Promoting skill development aligned with industry needs

Encouraging apprenticeships and on-the-job training

Supporting workforce reskilling and upskilling

Enhancing labour productivity

The emphasis is on creating quality jobs rather than just increasing employment numbers.

Infrastructure reforms are a major pillar of Budget 2026. Policy changes focus on:

Efficient project execution

Improved public-private partnership frameworks

Better asset monetisation

Streamlined approval processes

These reforms reduce project delays and crowd in private investment.

Budget 2026 accelerates reforms in digital governance through:

Expansion of digital public infrastructure

Paperless, faceless, and cashless systems

Use of data analytics for policy implementation

Integration of government platforms

Digital reforms improve efficiency, transparency, and service delivery.

To enhance global competitiveness, Budget 2026 promotes:

Simplification of trade procedures

Reduction in compliance costs for exporters

Improved logistics and trade facilitation

Alignment with global trade standards

These reforms help Indian businesses integrate into global markets.

Sustainability is a defining theme of Budget 2026 reforms. Policy changes encourage:

Clean energy adoption

Energy efficiency

Green manufacturing practices

Climate-resilient infrastructure

These reforms balance economic growth with environmental responsibility.

Union Budget 2026 continues reforms aimed at inclusivity by:

Strengthening targeted welfare delivery

Using technology to reduce leakages

Improving outcomes in health and education

Promoting regional and rural development

Inclusive reforms ensure that growth benefits reach all sections of society.

The Union Budget 2026 reflects a strong commitment to reform-oriented governance, focusing on long-term structural improvements rather than short-term measures. Through fiscal discipline, tax simplification, business-friendly regulations, financial sector strengthening, digital governance, and sustainability-focused policies, Budget 2026 lays the foundation for resilient, inclusive, and sustainable economic growth.

More than just a financial statement, Budget 2026 serves as a policy roadmap that strengthens institutions, builds confidence, and prepares India for future economic challenges and opportunities.

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

Email:

tally@binarysoft.com

Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)