Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

e-Invoicing is a system that allows the Invoice Registration Portal (IRP) to electronically verify B2B invoices. Accordingly, e-invoicing in TallyPrime provides you with a smooth experience to configure and generate e-invoices for your business. Once your e-invoice is generated successfully, the details of the e-invoice will reflect in GSTR-1.

TallyPrime’s e-invoicing solution can be easily used by all eligible entities such as taxpayers and tax consultants. In TallyPrime, you only have to record your sales transactions, as usual, and your e-invoice requirements will be covered in the same flow! Important details, such as IRN, Ack No., QR code, and e-Way Bill no., will be updated in the vouchers automatically, and you can proceed to print them. Moreover, TallyPrime will ensure that both your business and your compliance requirements are suitably addressed.

TallyPrime also provides you with the flexibility to generate e-invoices in bulk for multiple invoices. You can select one or more transactions from the e-Invoice report and generate the respective IRN, at your convenience.

We understand how valuable your data is for you and your business, and we have provided various measures in TallyPrime to safeguard your data. All the requests for online e-invoicing will pass through Tally GSP (TIPL), which has been awarded ISO 27001:2013 certificate for its stringent security policies. The best part is that you will not need any additional software or plugins to enjoy the benefits of e-invoicing in TallyPrime.

The GST Council has announced the following updates for e-invoicing.

| Businesses Having a Turnover of More Than… | Effective Date |

| 500 crores | 1st October 2020 |

| 100 crores | 1st January 2021 |

| 50 crores | 1st April 2021 |

| 20 crores | 1st April 2022 |

| 10 crores | 1st October 2022 |

TallyPrime provides you with an online e-invoicing solution that fits right into your regular invoicing process. e-Invoicing in TallyPrime is not restricted to only a particular voucher type. Apart from regular sales invoice, TallyPrime supports e-invoicing for POS, debit notes, and credit notes. What’s more, even receipts and journal vouchers are supported for e-invoicing when they are used for sales.

Click here if you want to watch the Hindi version of the video.

No matter how you record your supplies in TallyPrime, you can easily generate an IRN while saving your invoice and print the QR code and other details. Later, if you want to update the details of your transaction, then you can easily cancel the current IRN and get a fresh IRN for your updated invoice. This will ensure that the details in your e-invoice are up-to-date.

TallyPrime also provides you with the flexibility to generate multiple e-invoices at the same time. If you do not want to generate the e-invoice while recording the transaction, then you can do it later from the e-Invoice report. You can select one or more transactions from the sections in the report and generate the respective IRN for your e-invoices.

Moreover, you also have the choice of generating an e-Way Bill along with your e-invoice using TallyPrime, or even generate only the e-Way Bill without the e-invoice, if required.

In this section

Before you start recording your voucher for e-invoicing, ensure the following:

On the e-Invoice System:

In TallyPrime:

You can easily generate an IRN while saving your invoice and also print the QR code and other details.

While recording a GST Sales transaction,

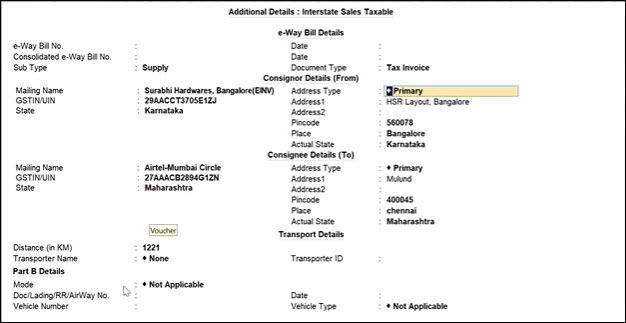

Mandatory Details for Generating e-Way Bill with e-Invoice

If you had chosen to generate an e-Way Bill along with your e-invoice, you will need to ensure that details, such as transporter information and accurate distance between pincodes, are correctly entered while recording the sales transaction.

Ensure that you specify these details in the Transporter Details section of the Statutory Details screen, while recording the invoice.

For more information, refer to e-Way Bill in TallyPrime.

If you do not want to generate an e-invoice while recording a transaction, then you can do it later from the Exchange menu. You can select one or more transactions, as needed, and generate the respective IRN for your e-invoices.

Click here to watch the Hindi version of the video.

For more details, you can go the e-Invoice report.

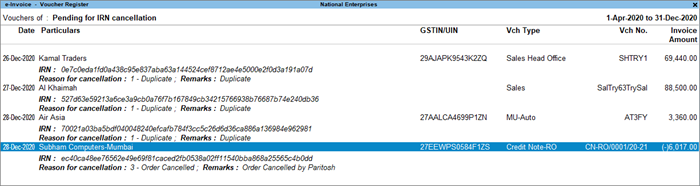

There may be situations where the IRN is generated for a particular voucher, but you might have to cancel it. For example, this can happen when there is a change in the rate of an item, or if the party has cancelled the order. In such cases, you may want to cancel the invoice. As per department regulations, invoice cancellation has to be done within 24 hours of IRN generation.

Press Ctrl+F10 (Mark as Cancelled) when the e-invoice is cancelled through some other medium on IRP, and you want to update the status in TallyPrime. When you mark the IRN as cancelled, then this invoice will appear in the Marked as IRN Cancelled section under IRN Cancelled, instead of the For IRN Cancellation section under Pending.

Now, you can send the e-Invoice for cancellation from the Exchange menu.

The voucher will move to the IRN cancelled from e-Invoice system section in the e-Invoice report. Even after cancellation, information like QR code and IRN details will be retained in the voucher for your reference in TallyPrime. You can also view the remarks you had entered while cancellation, using More Details.

Undo IRN/e-Invoice Cancellation

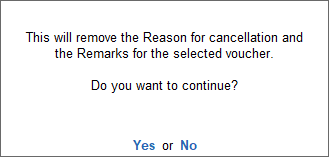

In certain situations, you may have cancelled the IRN for a particular voucher in TallyPrime, but now you want to undo this cancellation. For example, this might be needed when you had selected the wrong voucher for cancellation, or 24 hours have already passed since IRN generation, and the e-Invoice System won’t accept the cancellation anymore. In such cases, you can undo the IRN cancellation.

The Undo Cancellation feature is available in the Pending for IRN Cancellation, Exported for IRN Cancellation, and Marked as IRN Cancelled sections of the e-Invoice report. You can select the required voucher from any of these sections and proceed to undo IRN cancellation.

When you undo IRN cancellation for the selected voucher, it will remove the details of the cancellation, such as the Cancelled status, the Reason for cancellation, and the Remarks, and move the voucher to its original section in the e-Invoice report.

The Undo Cancellation feature is applicable only for the e-invoices cancelled in TallyPrime, and it does not undo the cancellation updated in the e-Invoice portal. If a voucher is not cancelled on the e-Invoice portal, then it should not be marked as cancelled in TallyPrime.

Sometimes, you may have generated or cancelled the IRN for vouchers in the offline mode using TallyPrime or some other software (or directly on IRP), and you may want to import the IRN information for those vouchers in TallyPrime. You can do so using the Get IRN Info facility, which will import the latest IRN, Ack. No., and Ack. Date along with the QR code from the e-Invoice system to the vouchers.

The facility is provided in the relevant sections of the e-Invoice report, such as Pending, Exported, or Rejected by e-Invoice System, where you can fetch the latest IRN information and update the vouchers.

TallyPrime also allows you to carry out e-invoicing in the offline mode, in case you do not have continuous access to the internet, or if you don’t want to send your invoice details directly to the portal. In such cases, you can export the details of your e-invoice to a JSON file and then upload it on IRP at your convenience.

What’s more, TallyPrime creates the offline files in the format and size recommended by IRP. If the data size is more than 2 MB, then the information will be split into multiple files, each of which will be less than 2 MB.

Click here to watch the Hindi version of the video.

In this section

Offline Export

The JSON files will be saved in the specified folder:

Bulk Upload on IRP

After exporting the JSON files, you can upload them on IRP and generate IRN information for the uploaded vouchers.

Update Details in TallyPrime and Print QR Code

Now you have to update the e-invoice details, such as IRN, Ack No., and Ack Date, in the respective vouchers in the e-Invoice report.

Offline Export

You can cancel the voucher in the offline mode by uploading the JSON file on IRP.

Bulk IRN/e-Invoice Cancel

After exporting the required JSON files, you can upload them on IRP and generate IRN information for the selected vouchers.

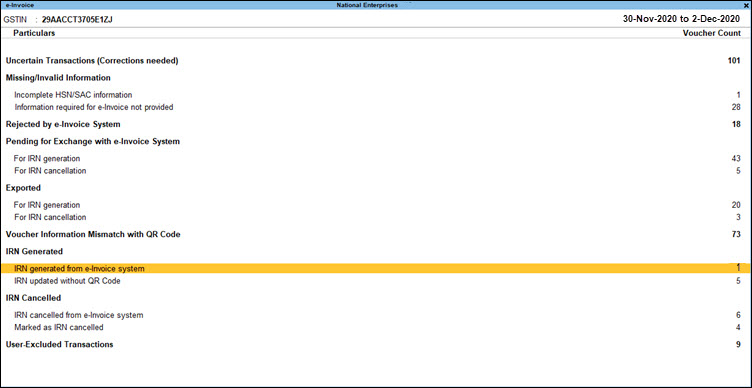

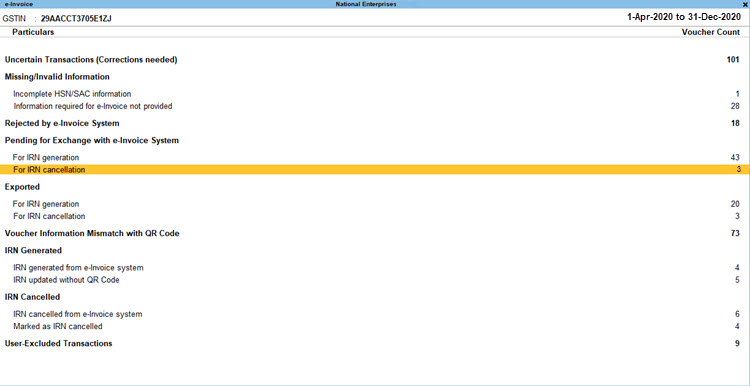

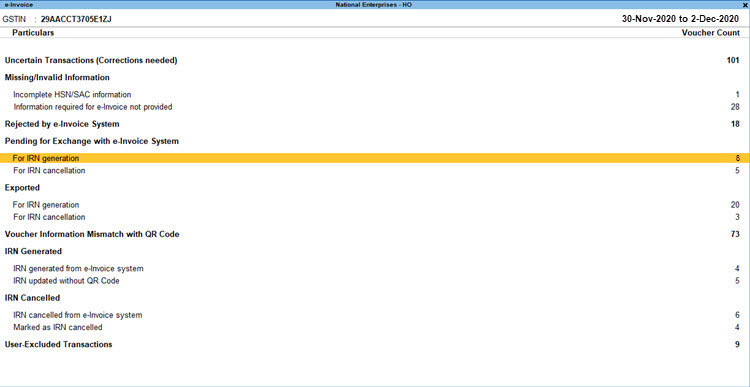

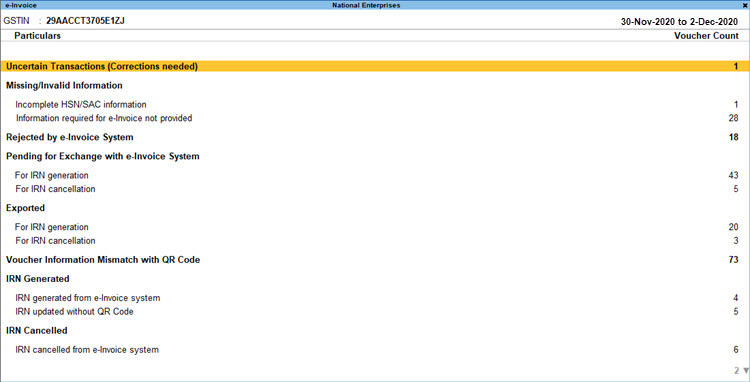

The e-Invoice report is a one-stop shop for your e-invoicing needs in TallyPrime. You can view the e-invoice status of your transactions, and take the next steps accordingly. You can perform e-invoicing operations such as IRN generation and cancellation of one or many transactions. You can also view the transactions where the details are incomplete or incorrect, and easily update the required information. Moreover, you can open the the e-invoice portal directly from the report, if required, by pressing Alt+V (Open e-Invoice Portal).

Press Alt+G (Go To) > type or select e-Invoice > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > e-Invoice > press Enter.

You can see the following sections depending on the status of your GST sales transactions.

IRN Register

The IRN Register is a single location where you can check the e-invoice status and other details of your transactions. If required, you can also remove IRN information from certain vouchers by pressing Alt+V (Remove IRN Info).

Uncertain Transactions (Corrections needed)

This section lists the transactions where there is mismatch or incomplete information in the voucher, ledger, or stock item. You can drill down from the transactions and resolve the uncertainties. You can also accept the transactions as is, or recompute the values, if needed.

Missing/Invalid Information

This section lists the transactions that have missing or invalid Information, which needs to be corrected before the IRN can be generated. The sub-sections include the transactions where HSN/SAC details are not provided, and the transactions where the information required for e-invoicing is not provided. Once you resolve these transactions, they will appear under Pending > For IRN Generation.

Rejected by e-Invoice System

This section lists the transactions where IRN generation/cancellation requests were rejected by IRP. The rejection can happen due to reasons such as duplicate IRN, invalid HSN code, and so on. You can drill down to the transaction and update it with the relevant details. After the transaction has been updated, press Alt+R (Mark as Resolved) to resolve the transaction. After being resolved, the transaction will appear under Pending > For IRN Generation.

Pending for Exchange with e-Invoice System

This section lists the transactions that are ready for IRN generation or cancellation, as they have no uncertain or missing information. You can proceed to the Exchange menu (Alt+Z (Exchange) > Send for e-Invoicing), and send the transactions to IRP for e-invoicing.

Exported

After the transactions are successfully sent to IRP for IRN generation or cancellation, they will appear in the Exported section.

Voucher Information Mismatch with QR Code

This section lists the transactions that were modified, either accidentally or deliberately, after the IRN was generated. This includes modifications in details such as voucher number, HSN, amount, and so on. You can drill down from this section, and press Alt+F1 for more details. You can see the invoice in two lines. The first line represents the transaction as per your books, while the second line represents the same transaction as per IRP. You can either update the transaction, as required, or cancel the IRN.

IRN Generated

This section lists the transactions where the IRN is generated from IRP, or manually updated in the offline mode using TallyPrime or other software. You can further update IRN information for the required transaction by pressing Alt+S (Manually Update IRN Info).

IRN Cancelled

This section lists all the transactions where the IRN is cancelled from IRP, or manually marked as cancelled in the offline mode in TallyPrime or other software.

User-Excluded Transactions

This section lists the transactions that you have chosen to exclude from the e-invoicing process. However, if you want to include certain transactions from this list for e-invoicing, then you can select the transactions and press Alt+H (Include Vouchers).

You can provide additional security for e-invoicing in TallyPrime by creating users with special rights, and authorizing them for specific operations. If you want to prevent any user from using the e-Invoicing feature or accessing the report, then you can use the Security Control feature to set up the required security levels.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)