Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

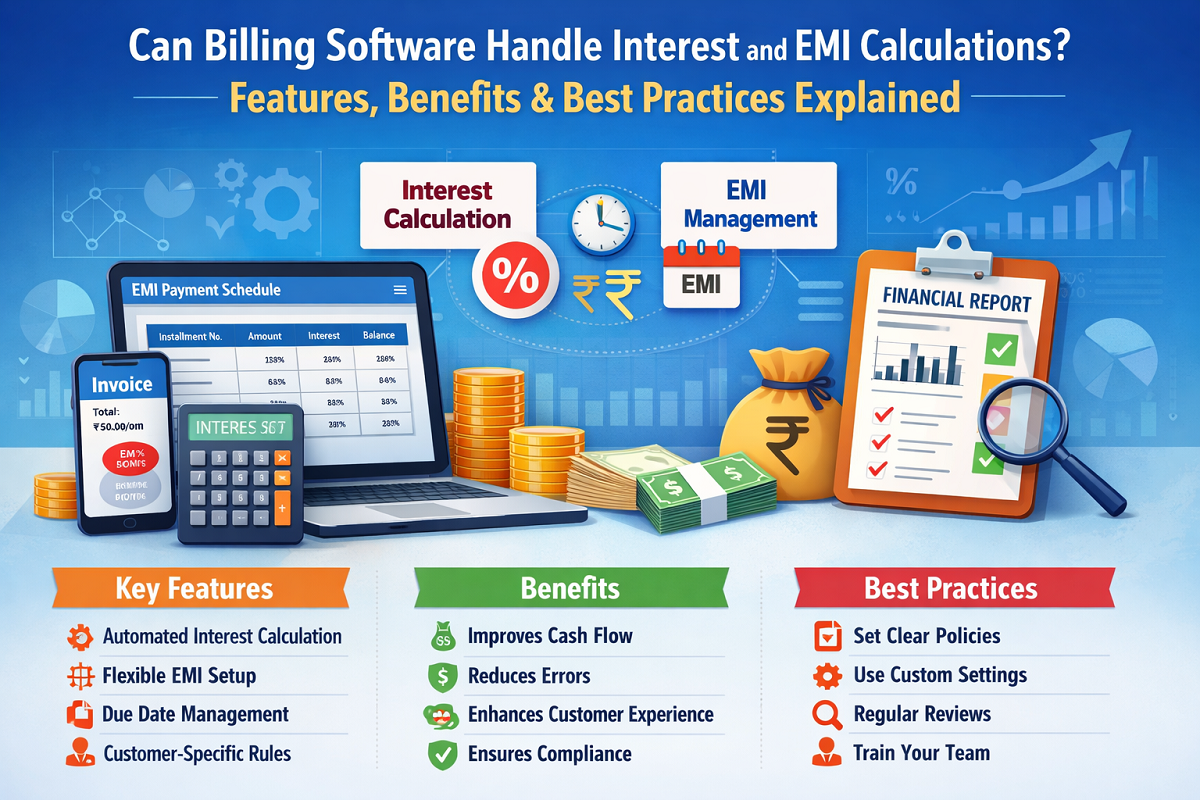

In today’s fast-paced business environment, billing software has evolved far beyond basic invoice generation. Modern billing and accounting systems are now capable of handling complex financial requirements such as interest calculation, EMI (Equated Monthly Installment) management, overdue charges, and flexible payment schedules.

For businesses offering credit sales, installment plans, or delayed payment options, these features are no longer optional—they are essential for maintaining cash flow, accuracy, and customer trust.

This article explains how billing software handles interest and EMI calculations, its key features, benefits for businesses, and best practices for effective implementation.

Interest calculation refers to the process of charging an additional amount on outstanding dues when customers delay payments beyond the agreed credit period. Billing software can calculate interest based on:

Fixed or variable interest rates

Daily, monthly, or annual basis

Simple or compound interest

Outstanding balance or overdue amount

EMI (Equated Monthly Installment) allows customers to pay the total invoice amount in fixed installments over a defined period. Billing software automates EMI calculations by dividing the principal amount and adding applicable interest, ensuring consistent monthly payments.

Modern billing software can automatically calculate interest on overdue invoices based on predefined rules. This reduces manual errors and ensures consistency across all customer accounts.

Businesses can configure:

Number of installments

EMI start and end dates

Interest-inclusive or interest-free EMIs

Monthly, quarterly, or custom installment cycles

This flexibility is especially useful for retailers, service providers, and B2B businesses.

Billing software allows you to define credit periods for each customer. Once the due date is crossed, the system automatically applies interest or late fees as per policy.

Different customers may have different credit terms. Billing software supports:

Customer-specific interest rates

Custom EMI structures

Separate penalty rules for high-risk accounts

Interest and EMI amounts are automatically posted to the correct ledgers, ensuring accurate accounting and compliance with financial standards.

Invoices and statements clearly show:

Principal amount

Interest charged

EMI breakup

Outstanding balance

This transparency improves customer trust and reduces disputes.

Advanced billing software provides reports such as:

Interest earned reports

EMI outstanding summaries

Overdue receivables analysis

Customer payment behavior insights

Manual calculations are time-consuming and prone to mistakes. Automated billing software ensures accuracy, speed, and reliability.

By systematically charging interest and tracking EMIs, businesses can encourage timely payments and maintain steady cash inflow.

Clear EMI schedules and transparent interest calculations help customers plan payments better, leading to stronger business relationships.

Businesses gain real-time visibility into:

Outstanding dues

Interest income

EMI collections

This enables smarter financial decision-making.

Proper recording of interest income and installment transactions helps in:

GST and tax compliance

Audit preparedness

Accurate financial reporting

As transaction volumes increase, billing software can handle thousands of EMI accounts and interest calculations effortlessly.

Billing software with interest and EMI capabilities is especially useful for:

Retail and wholesale businesses

Electronics and appliance dealers

Educational institutes

Healthcare service providers

Finance and NBFC-like operations

MSMEs offering credit sales

Before configuring the software, set clear rules regarding:

Credit period

Interest rate

Grace period

EMI terms

Communicate these policies clearly to customers.

Not all customers carry the same risk. Assign customized interest rates and EMI plans based on customer history and creditworthiness.

While automation is powerful, periodic reviews help ensure:

Correct configurations

Updated interest rates

Accurate customer data

Ensure invoices and statements clearly display interest and EMI details to avoid confusion or disputes.

Choose billing software that integrates seamlessly with accounting, taxation, and inventory modules for end-to-end financial management.

Ensure your billing and accounts team understands how interest and EMI features work to avoid incorrect usage.

When selecting billing software for interest and EMI handling, look for:

Customizable interest and EMI settings

Strong reporting capabilities

Easy integration with accounting and GST

User-friendly interface

Scalability and data security

Popular solutions like advanced accounting and billing platforms often provide these features as standard or add-on modules.

Billing software can effectively handle interest and EMI calculations when configured correctly. By automating complex calculations, improving accuracy, and providing clear financial insights, such software becomes a powerful tool for businesses offering credit and installment-based sales.

For MSMEs and growing enterprises, adopting billing software with robust interest and EMI features is not just about convenience—it’s about financial discipline, transparency, and sustainable growth.

Modern billing software can accurately manage interest and EMI calculations, helping businesses improve cash flow, reduce errors, and build long-term customer trust.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)