Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

Every Indian business—big or small—starts somewhere.

Sometimes:

And at some point, a very common question arises:

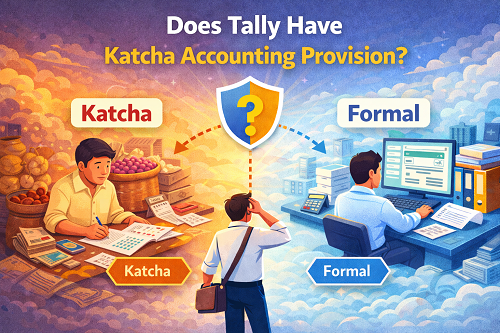

“Does Tally support katcha accounting?”

Some ask it directly.

Some avoid the word.

Some fear it’s illegal to even discuss.

Let’s pause right here.

This article is not about encouraging wrong practices.

It’s about understanding reality, system design, and how businesses actually operate.

And yes—we’ll answer the question clearly and honestly.

Before answering anything, we must define the term properly.

“Katcha accounting” is not a legal or technical term.

It’s a street-level business expression.

In practice, it usually means:

�� Tally does NOT have a feature officially called “katcha accounting.”

But…

�� Tally DOES allow businesses to record provisional, internal, optional, and non-final transactions.

This difference matters.

Very much.

Tally is designed as a compliance-ready accounting system.

Using the term “katcha” would:

Instead, Tally follows a clean, professional approach:

“Record everything—but give the user control over what becomes final.”

That’s smart design, not limitation.

In real-world usage, businesses often:

Tally supports this indirectly, through structured flexibility.

Instead of “katcha accounting”, Tally enables:

This means:

That balance is powerful.

Indian businesses operate in environments where:

A rigid system would fail here.

Tally doesn’t fail—because it allows business-first recording with compliance-ready finalization.

Here’s the honest answer:

Tally supports the first.

It does not promote the second.

That line is clear.

And that’s exactly how responsible software should behave.

Many people confuse these two:

Accounting

Compliance

Tally allows accounting flexibility, but ensures compliance discipline.

That’s why it’s trusted by:

If Tally openly allowed “katcha accounting” as a feature:

Instead, Tally ensures:

Most successful businesses follow this path:

Informal → Semi-formal → Fully compliant

Tally is built to support that journey, not force it overnight.

It lets businesses:

That’s evolution—not pressure.

No—Tally does not officially support “katcha accounting.”

But yes—Tally absolutely supports provisional, internal, and non-final business recording, done responsibly and transparently.

And that’s exactly why it works so well in India.

If you understand this distinction, you stop fearing the system—and start using it smartly.

Powered by Binarysoft Technologies

Authorized Tally Partner

Location : 1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact us : +91 7428779101, 9205471661, 8368262875

Email us : tally@binarysoft.com (10:00 AM – 6:00 PM, Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)