Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

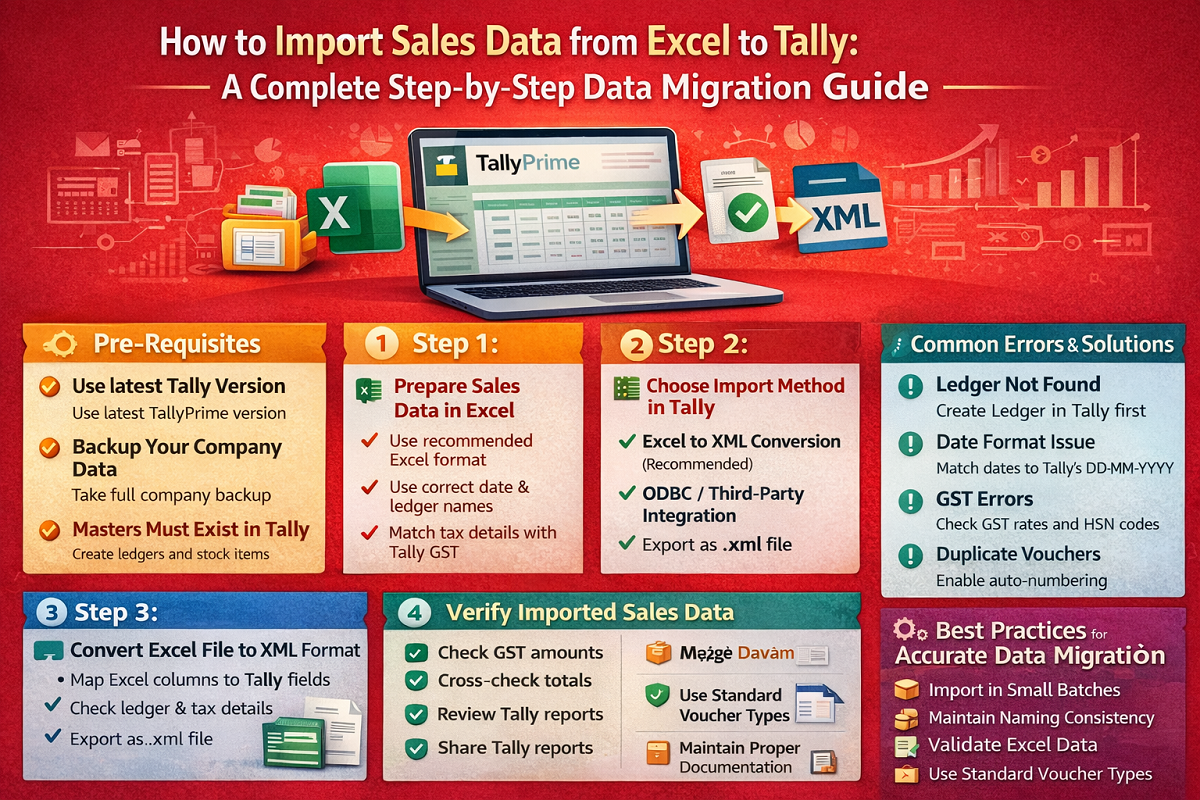

Importing sales data from Excel to Tally is a common requirement for businesses migrating from manual records, legacy software, or bulk sales data management. When done correctly, it saves time, reduces errors, and ensures accurate accounting and GST compliance. However, improper formats or missing details can lead to failed imports or incorrect financial records.

This guide explains everything you need to know—from preparation and Excel formatting to import methods, validation, and best practices—for smooth and error-free sales data migration into Tally.

Businesses often maintain sales records in Excel due to its flexibility. However, as transaction volume grows, Excel becomes inefficient for accounting, taxation, and reporting. Importing sales data into Tally offers several advantages:

Centralized accounting system

Automated GST calculation and reporting

Accurate ledger and inventory updates

Faster financial reporting and audits

Reduced manual data entry errors

Before starting the import process, ensure the following:

Use the latest version of TallyPrime, as it supports improved import features, GST validations, and error handling.

Always take a full backup of your Tally company before importing data to avoid data loss.

Ensure the following masters are already created in Tally:

Customer (Party) Ledgers

Sales Ledger

GST Ledgers (CGST, SGST, IGST)

Stock Items and Units (if inventory is used)

If masters are missing, Tally may reject the import or create incorrect entries.

Proper Excel formatting is the most important step for successful import.

Your Excel sheet should include columns such as:

Voucher Date

Voucher Number

Party Name

Sales Ledger Name

Item Name (for inventory sales)

Quantity

Rate

Taxable Value

GST Rate

CGST Amount

SGST Amount / IGST Amount

Invoice Total

Narration

Ensure:

Column names match Tally fields

Dates are in correct format (DD-MM-YYYY)

Ledger and item names exactly match Tally masters

Tally supports two main import methods for Excel sales data:

Tally imports data through XML format, so Excel data must be converted into XML using:

Tally Import Utility tools

Excel macros

Third-party Excel-to-Tally import tools

This method is best for bulk and recurring imports.

Advanced users can use ODBC or accounting automation tools to sync Excel data directly with Tally.

If using Excel-to-XML import:

Map Excel columns with Tally fields

Define voucher type as Sales

Assign ledger and GST details correctly

Validate data before export

Save the file as .xml format.

Follow these steps in TallyPrime:

Open TallyPrime

Select the company

Press Alt + O (Import)

Choose Masters or Vouchers

Select Vouchers

Choose XML as file format

Browse and select the XML file

Click Import

Tally will display:

Number of vouchers imported

Number of vouchers rejected

Error messages (if any)

After import, verification is critical.

Sales vouchers are created correctly

Party ledger balances match Excel data

GST amounts are calculated correctly

Stock quantities updated properly

Invoice totals are accurate

Use reports such as:

Day Book

Sales Register

GST Returns Report

Stock Summary

Solution: Create missing ledger in Tally before importing.

Solution: Ensure Excel dates match Tally’s date format.

Solution: Verify GST rates, HSN codes, and ledger GST settings.

Solution: Enable auto-numbering or correct voucher numbers in Excel.

Solution: Create stock items with the exact same name in Tally.

Avoid importing very large files at once. Test with small datasets first.

Ledger, item, and GST names must exactly match Tally masters.

Check for blank cells, incorrect totals, and mismatched GST values.

Always use standard Tally voucher types like Sales, Credit Note, or Debit Note.

Keep a record of import files, mappings, and logs for audit and troubleshooting.

Saves hours of manual data entry

Improves accounting accuracy

Ensures GST compliance

Enables faster financial reporting

Supports business scalability

This process is ideal for:

MSMEs migrating to Tally

Businesses handling bulk invoices

Accountants and consultants

Retailers and wholesalers

GST-registered businesses

Importing sales data from Excel to Tally is a powerful way to streamline accounting operations when done correctly. With proper Excel preparation, correct master creation, and systematic validation, businesses can migrate large volumes of sales data quickly and accurately.

By following this step-by-step guide, you can ensure error-free data migration, accurate GST reporting, and reliable financial records in Tally.

Accurate Excel to Tally sales import depends on clean data, correct masters, and systematic validation—test small, verify thoroughly, and scale confidently.

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

Email:

tally@binarysoft.com

Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)