Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

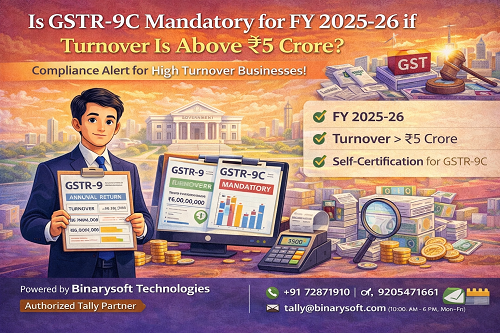

As businesses grow, GST compliance requirements increase, especially for taxpayers with higher turnover. One of the most frequently asked questions by businesses and professionals is:

“Is GSTR-9C mandatory for FY 2025-26 if turnover is above ₹5 crore?”

The confusion arises due to:

This article provides a clear, updated, and easy-to-understand explanation of GSTR-9C applicability for FY 2025-26, along with practical guidance for businesses.

GSTR-9C is a reconciliation statement that compares:

It highlights differences in:

GSTR-9C ensures financial transparency and correctness under GST law.

✅ Yes, GSTR-9C is mandatory for FY 2025-26 if aggregate turnover exceeds ₹5 crore.

As per current GST provisions, for FY 2025-26:

|

Particulars |

Applicability |

|

Aggregate Turnover |

Above ₹5 Crore |

|

GSTR-9 (Annual Return) |

Mandatory |

|

GSTR-9C (Reconciliation Statement) |

Mandatory |

|

Certification |

Self-certified by taxpayer |

This threshold is prescribed under GST law as implemented through decisions of the GST Council.

Earlier, GSTR-9C required certification by a Chartered Accountant or Cost Accountant.

Now:

�� This means compliance responsibility lies directly with the business.

Aggregate turnover includes:

❌ Excludes:

Turnover is calculated PAN-India, not GSTIN-wise.

GSTR-9C is mandatory for:

If aggregate turnover exceeds ₹5 crore, irrespective of:

GSTR-9C is not required if:

The due date for:

is generally 31st December following the end of the financial year, unless extended by notification.

�� For FY 2025-26, the expected due date is 31 December 2026 (subject to official notification).

GSTR-9C includes reconciliation of:

Accuracy is extremely important because:

Although there is no separate late fee prescribed specifically for GSTR-9C, non-filing can result in:

✔️ Filing on time avoids unnecessary compliance risk.

Using accounting platforms backed by Tally Solutions helps in:

For businesses seeking accurate and stress-free GST compliance:

Powered by Binarysoft Technologies – Authorized Tally Partner

�� Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

�� Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

�� Email:

tally@binarysoft.com

�� Working Hours:

10:00 AM – 6:00 PM (Mon–Fri)

What Binarysoft Technologies Offers:

For FY 2025-26, GSTR-9C is mandatory for all GST-registered taxpayers whose aggregate turnover exceeds ₹5 crore. Although CA audit is removed, self-certification increases responsibility, making accurate reconciliation more important than ever.

With the right tools and expert support, GSTR-9C compliance can be smooth and risk-free.

For professional assistance, trust Binarysoft Technologies.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)