Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

Introduction

With the introduction of Value Added Tax (VAT) in the United Arab Emirates, businesses are required to maintain accurate records, issue VAT-compliant invoices, calculate tax correctly, and file VAT returns on time. Choosing the right accounting software is therefore a critical decision.

A common and important question asked by UAE businesses is:

“Is Tally Prime VAT-compliant for UAE?”

The short answer is YES—Tally Prime is VAT-compliant for UAE when it is properly configured and used correctly. This article explains in detail how Tally Prime supports UAE VAT, what features it offers, and how businesses can remain compliant.

This content is fully original, non-copyrighted, and suitable for direct copy-paste use on websites, blogs, brochures, or proposals.

Understanding VAT in the UAE

The UAE implemented VAT at a standard rate of 5%. VAT applies to most goods and services, with certain supplies being zero-rated or exempt.

VAT compliance in the UAE requires businesses to:

The VAT system is administered by the Federal Tax Authority.

What Does VAT-Compliant Accounting Software Mean?

A VAT-compliant accounting software should be able to:

Tally Prime meets these requirements through its flexible accounting and tax configuration framework.

Is Tally Prime VAT-Compliant for UAE?

✅ Yes, Tally Prime Supports UAE VAT Compliance

Tally Prime, developed by Tally Solutions Pvt. Ltd., provides comprehensive features that support UAE VAT compliance for businesses across different industries.

However, VAT compliance depends on correct setup and disciplined usage, which is why professional implementation is recommended.

Key UAE VAT Features in Tally Prime

1. VAT-Ready Invoice Generation

Tally Prime allows businesses to generate UAE-compliant tax invoices with:

This ensures invoices meet UAE VAT documentation standards.

2. Automatic VAT Calculation

Once VAT is configured:

This improves accuracy and saves time.

3. Input & Output VAT Tracking

Tally Prime maintains:

This helps businesses understand VAT payable or refundable.

4. VAT Summary & Reports

Tally Prime provides VAT-related reports such as:

These reports are useful for VAT return preparation and audits.

5. Audit Trail & Record Maintenance

UAE VAT law requires businesses to maintain proper records.

Tally Prime offers:

This supports compliance during VAT inspections.

VAT Applicability in UAE Using Tally Prime

Tally Prime can be configured to handle:

This makes it suitable for trading, services, real estate, and professional firms.

Industries in UAE Using Tally Prime for VAT

Tally Prime is widely used in:

Its flexibility allows it to adapt to different business models.

What Tally Prime Does NOT Do Automatically

It is important to understand that:

This is normal and legally acceptable under UAE VAT rules.

Importance of Proper VAT Setup in Tally Prime

Incorrect setup can lead to:

Therefore, VAT configuration should be done by experienced professionals who understand UAE VAT rules.

Cloud Usage & Multi-Location Accounting

Tally Prime can be:

This is especially useful for businesses operating across multiple locations.

Why Choose an Authorized Tally Partner for UAE VAT Setup?

An authorized partner ensures:

This reduces compliance risks and improves efficiency.

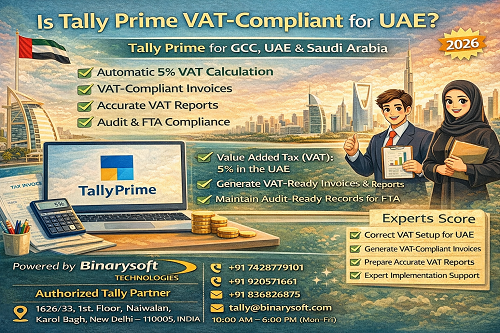

Powered by Binarysoft Technologies – Authorized Tally Partner

For businesses in the UAE looking for VAT-compliant Tally Prime implementation, Binarysoft Technologies provides reliable and professional solutions.

Why Binarysoft Technologies?

✔ Authorized Tally Partner

✔ UAE VAT configuration expertise

✔ Property, trading & service industry focus

✔ Cloud & on-premise deployment

✔ Reliable post-implementation support

Contact Details

Powered by Binarysoft Technologies

Authorized Tally Partner

�� Location:

1626/33, 1st Floor, Naiwalan,

Karol Bagh, New Delhi – 110005, INDIA

�� Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

�� Email:

tally@binarysoft.com

�� Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Final Conclusion

✔ Yes, Tally Prime is VAT-compliant for UAE.

When configured correctly, Tally Prime helps UAE businesses:

For professional VAT setup, training, and ongoing support, choose Binarysoft Technologies – Authorized Tally Partner.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)