Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

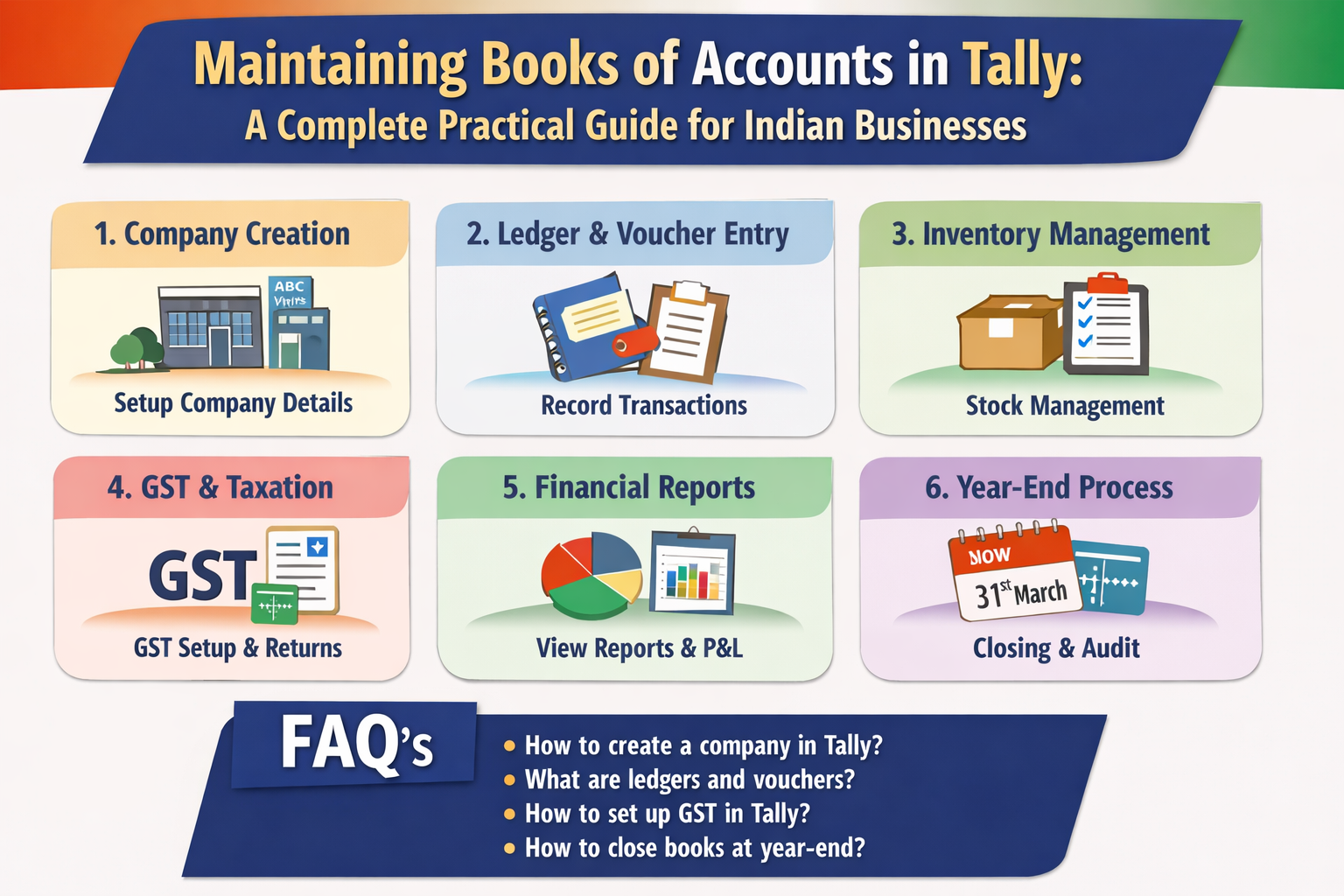

Maintaining proper books of accounts is a fundamental responsibility of every business in India. Accurate accounting not only helps a business understand its financial position but also ensures compliance with statutory requirements under the Income Tax Act, GST Act, and other applicable laws. Tally (especially Tally Prime) is one of the most trusted and widely used accounting software solutions in India, suitable for small traders, professionals, MSMEs, and large enterprises.

This complete practical guide explains in detail how Indian businesses can maintain their books of accounts in Tally, starting from basic concepts to daily accounting, GST compliance, reporting, and year‑end procedures.

Books of accounts are systematic records of all financial transactions of a business. They reflect:

Money received and paid

Assets owned and liabilities owed

Income earned and expenses incurred

Taxes payable and taxes paid

Mandatory under Income Tax Act for specified businesses

Required for GST return filing and audits

Helps in tracking profit or loss

Supports business planning and decision‑making

Essential for loans, investors, and compliance

Tally automatically generates most books of accounts once transactions are correctly entered.

Once data entry is done properly, Tally maintains the following automatically:

Cash Book

Bank Book

Journal

Ledger Accounts

Purchase Register

Sales Register

GST Registers

Stock Summary (for trading/manufacturing businesses)

Download Tally Prime from the official website

Install the software on your system

Activate License or use Educational Mode

Launch Tally Prime

Gateway of Tally appears (main control screen)

Correct company creation is the foundation of proper accounting.

Open Tally → Select Create Company

Enter Company Name (legal business name)

Enter Mailing Name and Address

Select Country – India

Select State (important for GST)

Enter PIN Code

Set Financial Year (1 April to 31 March)

Set Books Beginning From date

Save the company after verifying details.

Go to F11 – Features to enable required options.

Maintain Accounts: Yes

Bill‑wise Details: Yes

Cost Centres (optional)

Interest Calculation (if required)

Maintain Inventory: Yes

Units of Measure: Yes

Godowns (optional)

Enable Goods and Services Tax (GST)

Enter GST Registration Type

Enter GSTIN

Set applicable GST rates

Groups classify accounts into Assets, Liabilities, Income, and Expenses.

Examples:

Capital Account

Loans (Liability)

Sundry Debtors

Sundry Creditors

Direct Expenses

Indirect Expenses

Ledgers are individual accounts used for recording transactions.

Examples:

Cash

Bank Account

Customer Ledger

Supplier Ledger

Rent Expense

Salary Expense

Correct grouping is essential for accurate final reports.

Group: Capital Account

Group: Cash‑in‑Hand

Group: Bank Accounts

Enter opening balance

Rent, Salary, Electricity, Telephone

Group: Direct or Indirect Expenses

Group: Sundry Debtors

Enable GST details

Group: Sundry Creditors

Enable GST details

Daily transaction entry is the core of maintaining books of accounts.

Used when money is received.

Cash received from customer

Bank receipt

Used when payment is made.

Office expenses

Supplier payments

Used for cash and bank transfers.

Cash deposited into bank

Cash withdrawn from bank

Used for recording sales.

Select party

Select stock item or ledger

GST calculated automatically

Used for recording purchases.

Enter supplier invoice details

Apply GST correctly

Used for adjustments.

Depreciation

Provisions

Rectification entries

For trading or manufacturing businesses:

Create Stock Groups

Create Stock Items

Define GST rates

Maintain opening stock

Stock Summary

Godown Summary

Movement Analysis

Correct GST configuration ensures smooth compliance.

Correct GSTIN of parties

Proper tax classification

Correct place of supply

GSTR‑1

GSTR‑3B

GST Summary

HSN Summary

Always resolve errors shown in GST reports before filing returns.

Bank reconciliation ensures accuracy between bank books and bank statements.

Open Bank Ledger

Select Bank Reconciliation

Match transactions

Benefits include fraud prevention and accurate cash position.

Outstanding reports help track dues.

Outstanding Receivables

Outstanding Payables

These reports assist in cash flow management and follow‑ups.

Tally automatically generates final accounts.

Trial Balance

Profit & Loss Account

Balance Sheet

Cash Flow Statement

Fund Flow Statement

These reports reflect the true financial health of the business.

Before closing the financial year:

Verify all ledgers

Reconcile bank accounts

Verify GST returns

Adjust depreciation

Verify closing stock

Create a new financial year without losing previous data.

Enable automatic backup

Create multiple users

Assign roles

Use security passwords

Incorrect ledger grouping

Ignoring GST errors

Mixing personal and business expenses

Not reconciling bank regularly

Not taking backups

Record transactions daily

Maintain supporting bills and invoices

Reconcile monthly

Review reports regularly

Get accounts reviewed by professionals

Maintaining books of accounts in Tally becomes simple and effective when the system is properly set up and transactions are recorded regularly. With disciplined accounting practices, Indian businesses can ensure statutory compliance, financial transparency, and long‑term growth. Tally serves as a powerful tool to manage accounting, inventory, and taxation efficiently under one platform.

Powered by Binarysoft Technologies

Authorized Tally Partner

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101, 9205471661, 8368262875

Email:

tally@binarysoft.com

(10:00 AM – 6:00 PM, Monday to Friday)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)