Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

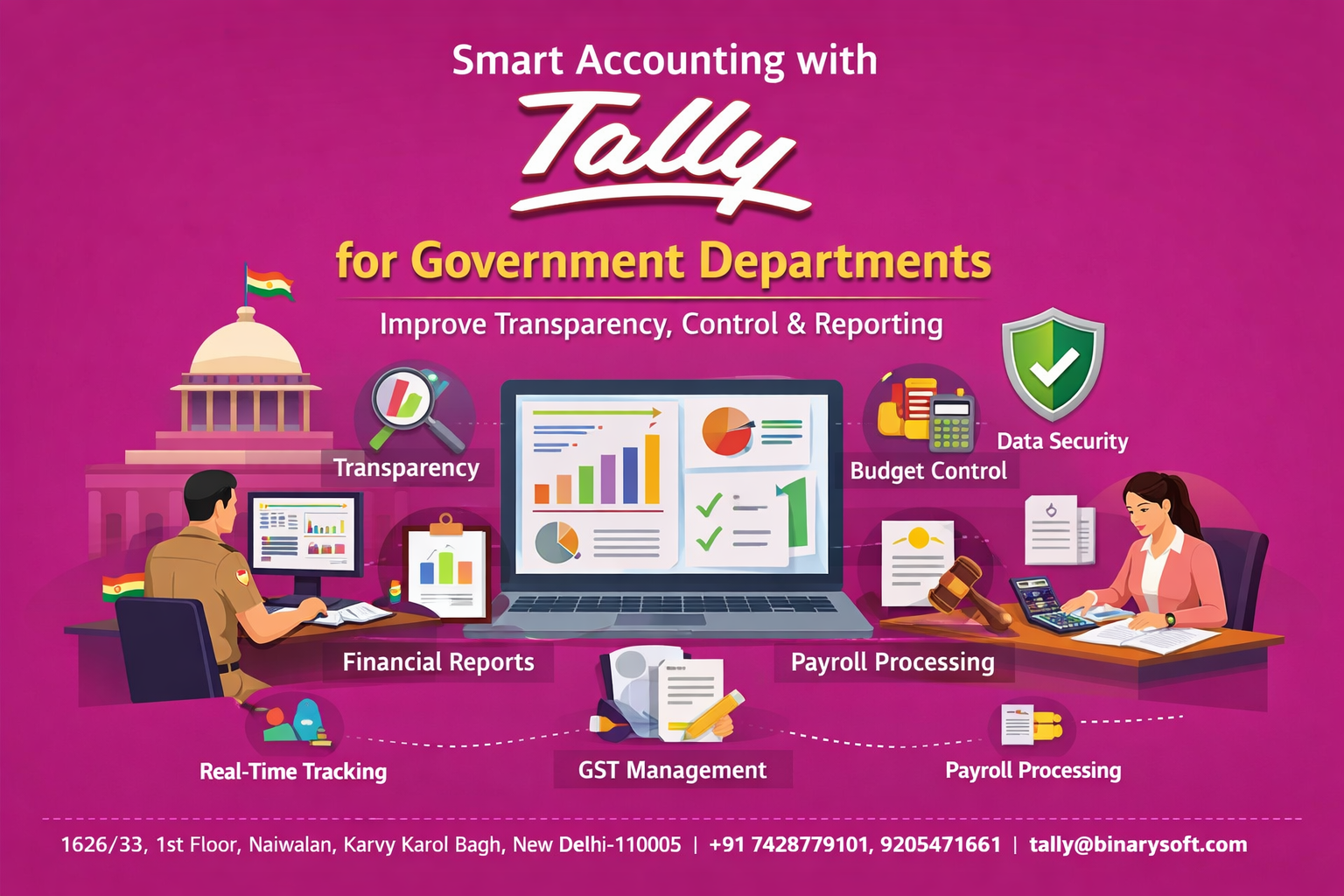

Government departments in 2026 are operating in an environment where financial transparency is no longer optional—it is expected. Over recent months, audit scrutiny has increased, digital reporting requirements have expanded, and accountability standards across public sector organizations have become more stringent. Departments are under growing pressure to maintain accurate records, justify expenditures, and deliver real-time financial reports to oversight bodies. Manual bookkeeping and fragmented systems are struggling to meet these expectations, often leading to reporting delays and audit observations.

What changed recently is the shift toward data-driven governance. Decision-makers want instant access to financial insights, auditors expect structured digital trails, and citizens demand responsible use of public funds. The benefit of adopting a smart accounting platform like Tally is immediate: improved financial control, faster reporting, reduced errors, and stronger compliance readiness. In 2026, modern accounting is not just a technological upgrade for government departments—it is a foundation for trust and effective governance.

A regional government office responsible for infrastructure projects managed dozens of vendors and multiple budget allocations. For years, the finance team relied on manual registers supplemented by spreadsheets. During audit season, files were stacked across desks, and staff worked late reconciling entries.

One year, a minor mismatch between departmental records and vendor payments triggered a lengthy audit query. Although the discrepancy was eventually resolved, the process consumed valuable administrative time and created unnecessary stress.

After transitioning to a structured accounting system, the department experienced a noticeable transformation. Financial records became organized, reports could be generated instantly, and audit preparation no longer felt overwhelming. Leadership gained clearer visibility into fund utilization, enabling more confident planning for future projects.

This story mirrors the broader shift happening across government institutions—where modernization is enabling efficiency, accountability, and confidence.

Public sector financial management has grown increasingly complex. Departments handle budget allocations, grants, project expenditures, procurement payments, and payroll—all while ensuring compliance with regulatory frameworks.

Common challenges include:

Managing multiple funding sources

Tracking project-based expenditures

Maintaining accurate utilization records

Preparing audit-ready financial statements

Ensuring regulatory compliance

Monitoring vendor payments

Generating timely financial reports

Without a structured accounting system, maintaining clarity across these areas becomes difficult.

Tally provides a centralized framework that helps government departments manage finances with greater precision and accountability.

Structured records allow departments to clearly demonstrate how funds are allocated and utilized. This strengthens institutional credibility and public trust.

Leadership can access up-to-date financial data whenever needed, supporting faster administrative decisions and improved governance.

Departments can monitor spending against approved budgets, helping prevent overspending and improving fiscal discipline.

Well-maintained ledgers and traceable transactions significantly reduce audit stress and improve compliance outcomes.

Clear payable records help ensure timely payments while maintaining accountability for public expenditure.

Transparent financial records reinforce responsible fund management and support oversight requirements.

Automation minimizes repetitive manual tasks, allowing staff to focus on strategic initiatives rather than corrections.

Structured accounting reduces the risk of duplication, misposting, or calculation errors.

When leadership has access to reliable financial data, planning and execution become more effective.

As programs expand and budgets grow, a modern accounting system supports increasing complexity without compromising clarity.

Government departments often operate multiple projects simultaneously, each with its own financial structure. Tracking these expenditures manually can create confusion and reporting delays.

A centralized accounting approach enables departments to:

Monitor project spending in real time

Compare allocated versus utilized funds

Identify cost overruns early

Improve financial forecasting

This level of visibility strengthens program execution and financial discipline.

Regulatory expectations continue to evolve, with greater emphasis on documentation and transparency. Disorganized records can lead to audit observations and operational delays.

Structured accounting ensures:

Every transaction is traceable

Documentation aligns with financial entries

Reports are generated quickly

Compliance risks are minimized

For government bodies, this translates into smoother audits and stronger institutional reputation.

Departments should evaluate their systems if they experience:

Frequent reporting delays

Difficulty retrieving financial data

Audit-related stress

Manual reconciliation challenges

Limited visibility into budget utilization

Heavy reliance on spreadsheets

Recognizing these indicators early helps prevent larger administrative complications.

Effective governance depends on more than policy—it requires disciplined financial management. When departments operate with clear financial insight:

Resource allocation improves

Wasteful spending declines

Oversight becomes easier

Public confidence strengthens

Accounting evolves from a routine function into a strategic governance tool.

Public sector institutions are steadily moving toward digital ecosystems. Integrated platforms, electronic procurement systems, and online reporting frameworks are becoming standard.

Departments that modernize their accounting processes position themselves for:

Higher operational efficiency

Stronger compliance readiness

Better inter-departmental coordination

Greater resilience during administrative transitions

Modern financial systems support long-term institutional stability.

Government departments in 2026 face rising expectations for transparency, accountability, and efficiency. Traditional accounting methods are no longer sufficient to manage expanding financial responsibilities.

Smart accounting with Tally enables public sector organizations to improve financial control, streamline reporting, and strengthen audit readiness. By replacing fragmented processes with structured financial management, departments gain the clarity needed to govern effectively.

Modern accounting is more than a technological shift—it is a commitment to responsible governance. Departments that invest in financial modernization today are better equipped to serve their stakeholders tomorrow.

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

Email:

tally@binarysoft.com

Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)