Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

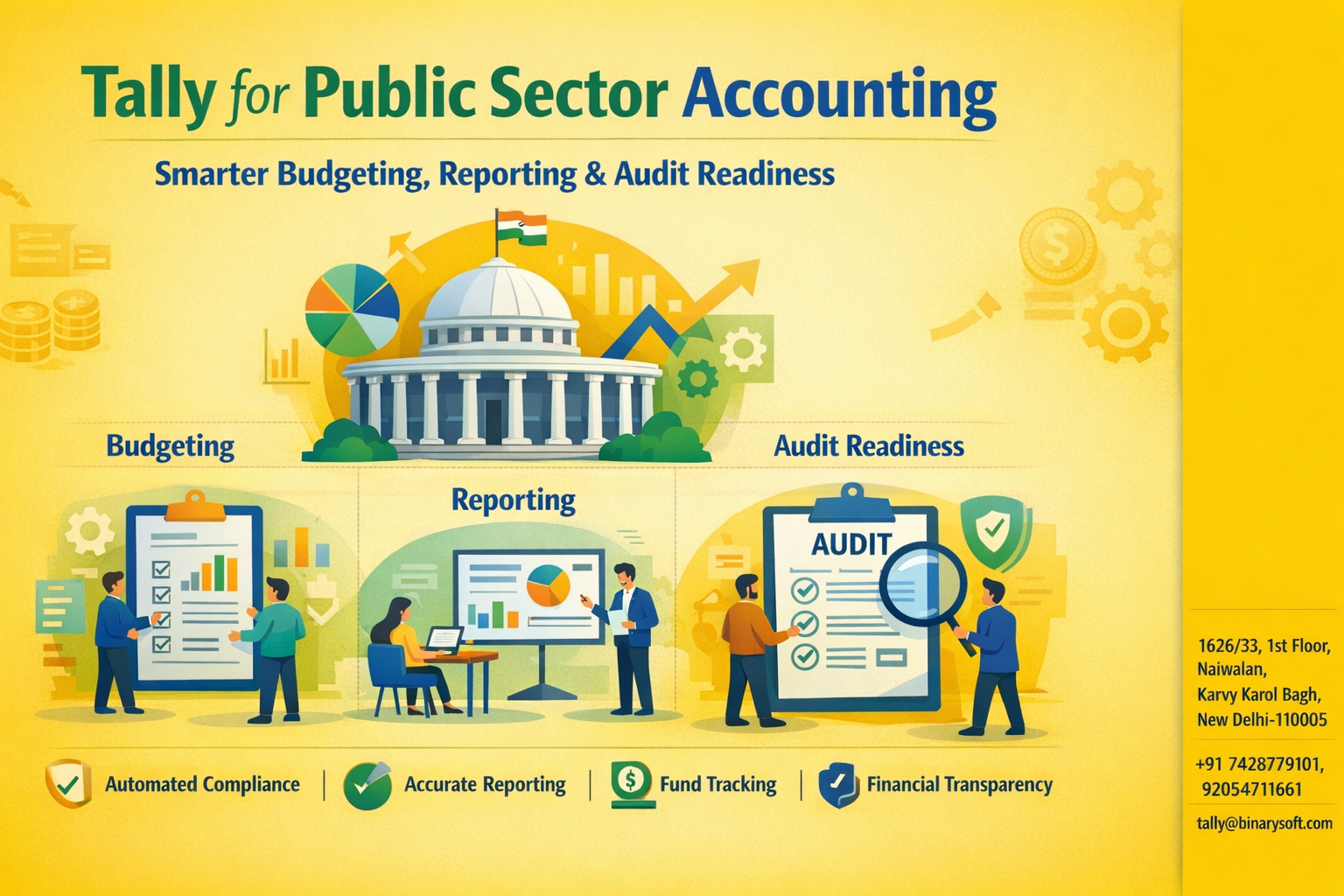

Public sector accounting is entering a new era in 2026. Recent months have brought stricter audit mechanisms, faster compliance timelines, and rising expectations for real-time financial transparency across government bodies and public institutions. Funding agencies and oversight authorities are demanding clearer utilization records, while leadership teams are under pressure to justify every allocation with accurate data. Manual registers, delayed reconciliations, and scattered spreadsheets are no longer sufficient in an environment where accountability is constantly examined. Even a small reporting gap can trigger audit observations or slow down project approvals. Institutions that have transitioned to structured digital accounting are already seeing the benefit—smarter budgeting, instant reporting, stronger audit trails, and significantly reduced administrative stress. The message is unmistakable: modern financial management is no longer a progressive choice; it has become essential for institutions that want to operate with credibility and control.

A regional healthcare authority learned this the hard way during a large infrastructure expansion. Multiple hospitals were being upgraded simultaneously, and funds were flowing across departments for equipment, construction, and staffing. The finance team believed everything was under control—until the annual audit approached.

What followed were weeks of intense pressure.

Files had to be gathered from different offices. Payment records were stored in multiple formats. Reconciling project-wise expenses became a race against time. Officers stayed late, worried not about misused funds, but about whether they could present the data clearly enough.

Then came a turning point.

The authority adopted a structured accounting platform designed for public sector workflows. Budget allocations were mapped directly to expenditures. Reports could be generated within minutes. Each transaction automatically created a verifiable audit trail.

The next audit felt completely different.

Instead of anxiety, there was preparedness. Instead of scrambling, there was clarity.

Most importantly, leadership regained confidence in their financial governance.

This story reflects a growing realization across the public sector: financial clarity is inseparable from institutional trust.

Public institutions today operate under sharper scrutiny than ever before. Citizens expect transparency. Regulators demand precision. Leadership requires reliable insights to guide policy decisions.

Modern public sector organizations must manage:

Annual and project-based budgets

Grants and fund allocations

Vendor and contractor payments

Department-wise expenditures

Compliance documentation

Utilization certificates

Audit-ready records

Financial disclosures

Handling these responsibilities through fragmented processes increases operational risk and slows decision-making.

Financial discipline is no longer just administrative—it is strategic.

Traditional budgeting often focuses on allocation rather than continuous monitoring. But in today’s governance environment, visibility into how funds are used is just as important as approving them.

Without real-time tracking, institutions may face:

Over-allocation in certain programs

Underutilization of critical funds

Delayed corrective action

Reduced financial agility

Smarter budgeting connects planning with execution. When administrators can see exactly where funds are flowing, they can make timely adjustments and ensure resources create meaningful impact.

Structured accounting transforms budgets into active management tools rather than static documents.

Delayed reports affect more than internal workflows—they can slow project execution and weaken leadership confidence.

A modern accounting system enables:

Automated financial statements

Department-wise expense summaries

Quick responses to oversight queries

Data-driven administrative decisions

Speed in reporting directly contributes to institutional effectiveness.

Organizations that generate reliable reports quickly are better equipped to navigate complex regulatory environments.

Audits are often perceived as disruptive events. In reality, they should simply validate the strength of existing processes.

Continuous audit readiness ensures that records are organized every day, not assembled under pressure.

Benefits include:

Reduced audit preparation time

Clear transaction histories

Stronger internal controls

Faster resolution of audit queries

Greater confidence among stakeholders

When transparency is embedded into daily workflows, audits become procedural rather than stressful.

Tally offers a structured financial framework that aligns with the operational needs of public institutions.

Track allocations alongside expenditures to maintain fiscal discipline and prevent deviations.

Every transaction contributes to a clear financial history, reinforcing accountability.

Generate accurate reports quickly, enabling leadership teams to focus on strategy instead of manual consolidation.

Reduced manual intervention minimizes errors and enhances reporting credibility.

Permission-based access strengthens responsibility while protecting sensitive financial data.

Together, these capabilities support efficient and transparent governance.

Transparency is no longer viewed solely as a compliance requirement—it is increasingly recognized as a foundation of institutional credibility.

Organizations with structured financial systems can:

Strengthen stakeholder confidence

Accelerate funding approvals

Demonstrate responsible resource management

Enhance long-term program sustainability

Trust grows naturally when financial clarity is visible.

Behind every balance sheet are professionals dedicated to public service. Yet outdated processes often create unnecessary strain.

When data is unclear, teams double-check numbers repeatedly. Leaders hesitate before approving initiatives. Administrative energy shifts from progress to verification.

Structured accounting changes this dynamic.

Teams operate with assurance. Decision-makers act with conviction. Workplaces feel calmer and more focused.

Technology does not replace expertise—it amplifies it.

Public institutions often recognize the need for transformation only when pressure escalates. Early indicators include:

Lengthy report preparation cycles

Difficulty tracking real-time expenditures

Stressful audit preparations

Dependence on manual records

Limited financial visibility

Frequent reconciliation delays

Addressing these signals proactively strengthens governance and operational resilience.

Governance is steadily shifting toward digital accountability and data-driven oversight. Institutions that modernize their financial infrastructure today position themselves for long-term success.

Future-ready organizations prioritize:

Clarity – Every financial movement is traceable.

Control – Structured workflows reinforce compliance.

Continuity – Scalable systems support expanding responsibilities.

Modern accounting is not just an operational upgrade—it is a commitment to stronger public administration.

Public sector accounting sits at the heart of responsible governance. As audit expectations rise and financial oversight becomes more sophisticated, institutions must adopt systems capable of supporting smarter budgeting, faster reporting, and uninterrupted audit readiness.

Tally provides a structured approach that helps public organizations maintain accurate records, monitor fund utilization effectively, and respond confidently to regulatory scrutiny.

When financial processes are organized, leadership gains the freedom to focus on delivering outcomes rather than resolving uncertainties. Transparency becomes routine. Accountability becomes demonstrable.

In an era defined by governance excellence, strong financial management is not merely beneficial—it is foundational to institutional trust and long-term public value.

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

Email:

tally@binarysoft.com

Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)