Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

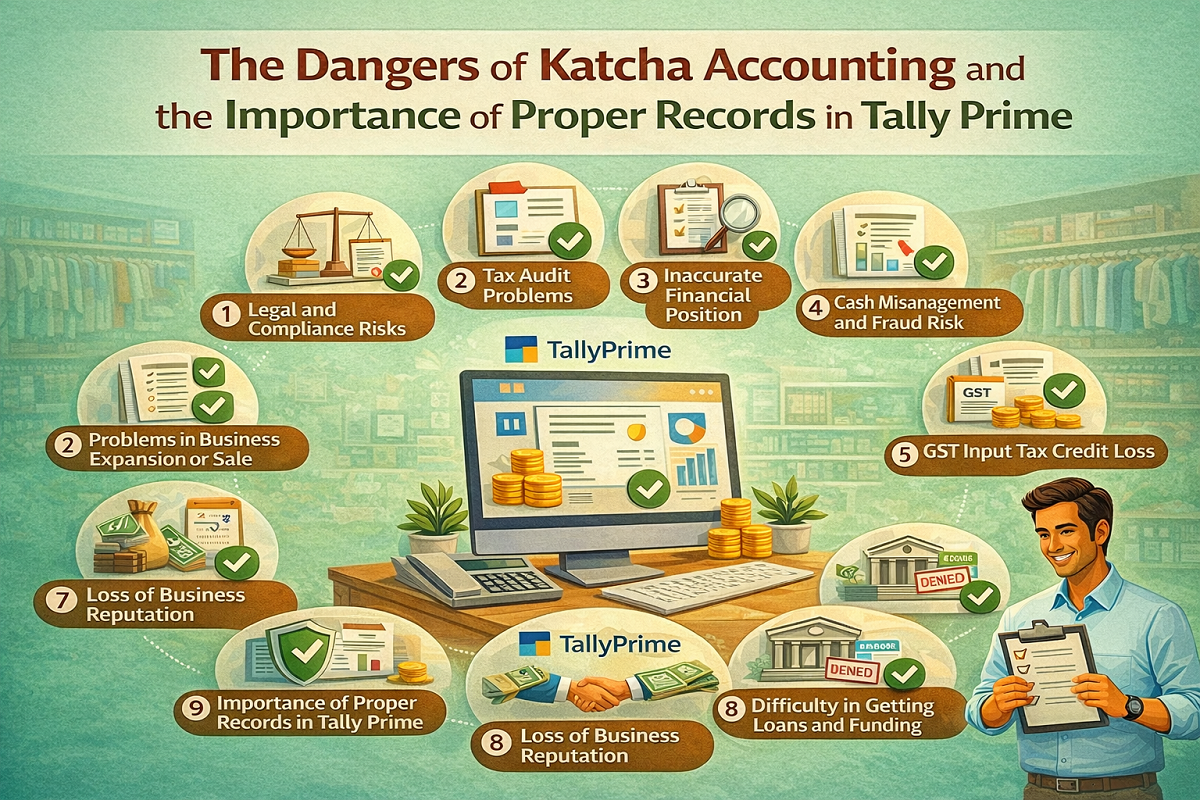

Katcha accounting is the practice of maintaining informal, incomplete, or unofficial financial records instead of proper books of accounts. Many businesses adopt this method to avoid taxes or reduce paperwork. However, in today’s regulated environment, katcha accounting can lead to serious legal, financial, and operational risks.

Tally Prime is designed to help businesses maintain accurate, transparent, and compliant records. This document explains the dangers of katcha accounting and highlights the importance of maintaining proper records using Tally Prime.

Katcha accounting often results in:

Underreporting of income

Incorrect GST returns

Missing invoices and vouchers

Government authorities require accurate financial records during inspections or audits. Katcha records fail to meet legal standards.

Impact: Heavy penalties, interest, notices, and possible legal action.

During income tax or GST audits:

Books must match bank statements

Sales and purchases must be supported by invoices

Stock records must be accurate

Katcha accounting cannot provide proper documentation.

Impact: Disallowed expenses, tax additions, and loss of credibility.

Without proper accounting:

Profit or loss figures are unreliable

Expenses may be ignored or overstated

Business decisions are based on wrong data

Tally Prime provides real-time Profit & Loss and Balance Sheet reports, which katcha accounting cannot.

Katcha accounting increases the risk of:

Cash leakage

Unauthorized transactions

Internal fraud

Tally Prime tracks every transaction with vouchers, reducing financial misuse.

Without proper GST-compliant records:

Input tax credit cannot be claimed

Incorrect GST filings become common

Reconciliation issues arise

Tally Prime ensures accurate GST calculation and compliance.

Banks and financial institutions require:

Audited financial statements

Tax returns

Clear business performance data

Katcha accounting fails to provide these documents.

Impact: Loan rejection and limited business growth.

Businesses using katcha accounting:

Lose trust with suppliers

Appear unreliable to partners

Struggle to attract investors

Proper accounting in Tally Prime enhances professional image and transparency.

When expanding, merging, or selling a business:

Clean financial history is required

Katcha records reduce valuation

Tally Prime maintains structured historical data, improving business value.

Accurate accounting & inventory integration

GST-ready invoicing

Real-time financial reports

Data security & audit trail

Easy compliance with laws

Tally Prime transforms accounting from a burden into a business strength.

Proper accounting:

Reduces fear of audits

Improves decision-making

Builds long-term stability

Using Tally Prime ensures confidence, clarity, and control.

Katcha accounting may appear convenient, but it exposes businesses to serious risks. Legal penalties, tax issues, financial confusion, and growth limitations make it unsustainable. Maintaining proper records in Tally Prime is essential for compliance, transparency, and long-term success. Businesses that shift from katcha to proper accounting gain security, credibility, and growth opportunities.

Powered by Binarysoft Technologies

Authorized Tally Partner

Location : 1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact us : +91 7428779101, 9205471661, 8368262875

Email us : tally@binarysoft.com (10:00 AM – 6:00 PM, Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)