Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

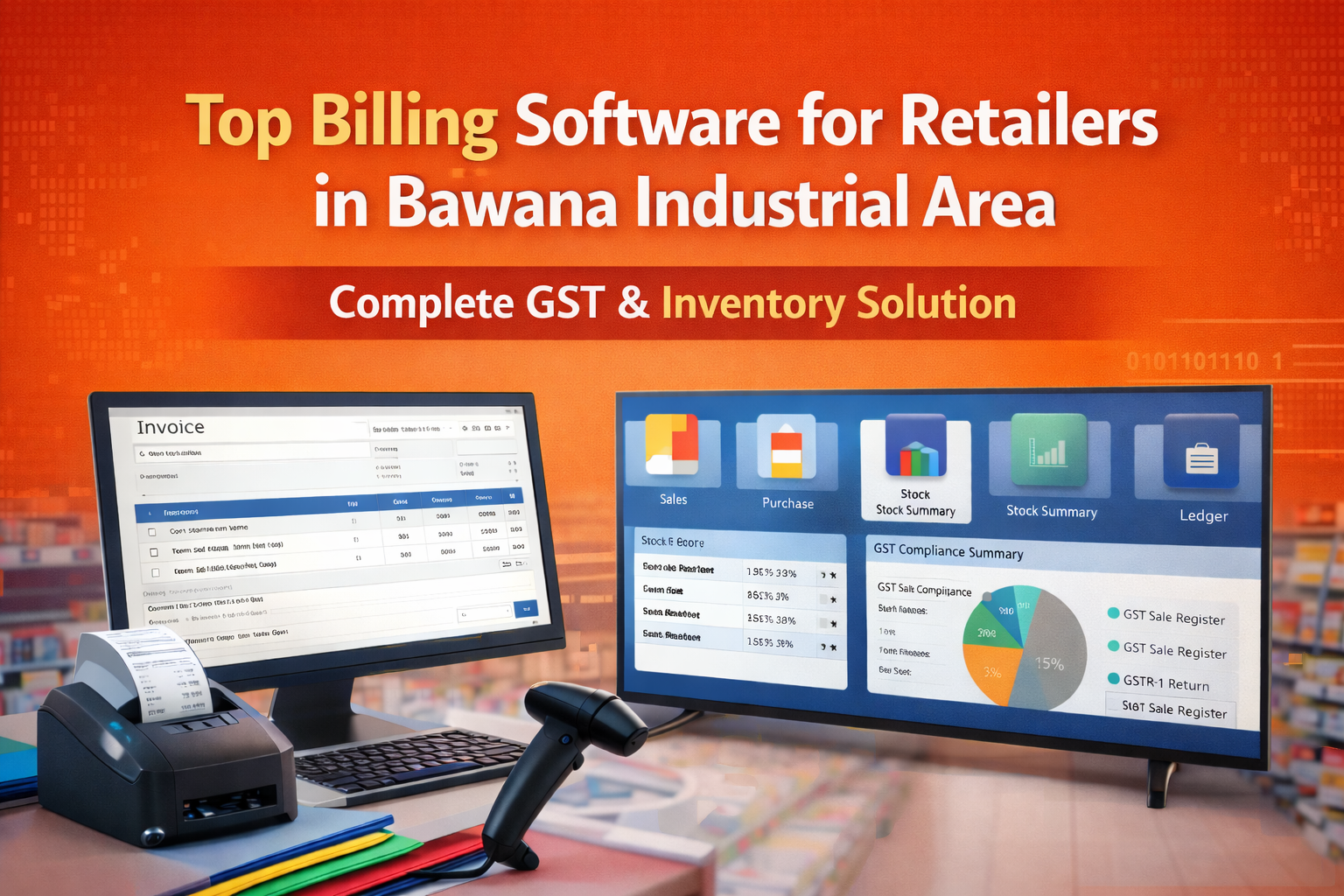

In 2026, retail businesses in Bawana Industrial Area are facing faster competition, stricter GST monitoring, and rising operational pressure. Over the last few months, GST departments have increased data matching, inventory tracking, and return scrutiny. At the same time, customers now expect faster billing, accurate invoices, and transparent pricing — even during peak business hours.

Many retailers are realizing that manual billing or outdated software is no longer enough. Delays at the counter, stock mismatches, GST errors, and late return filing are directly affecting business growth and reputation.

This is why retailers across Bawana Industrial Area are rapidly shifting towards modern billing software with complete GST and inventory integration. The right billing system not only simplifies daily sales but also reduces compliance stress, improves stock control, and helps business owners make smarter decisions — without increasing manpower or workload.

Bawana Industrial Area is one of Delhi’s major manufacturing and retail hubs. Businesses here handle:

High daily billing volume

Multiple items and stock categories

GST-compliant invoicing

Credit customers and suppliers

Inventory movement between godowns

Without proper billing software, retailers often face problems such as incorrect GST calculation, stock shortages, delayed reports, and accounting confusion.

A modern billing solution helps retailers manage everything from sales to compliance in one system.

A small electrical goods retailer in Bawana Industrial Area was managing billing manually for years. During busy hours, customers waited in long queues while bills were prepared. Stock records were maintained in notebooks, and GST returns were prepared at the end of the month with guesswork.

In early 2026, the business received a GST mismatch notice due to incorrect stock and invoice data. The owner realized that growth had outpaced his system.

After implementing a GST-ready billing and inventory software, billing time reduced drastically. Stock reports became accurate, GST summaries were auto-generated, and monthly compliance became stress-free.

Today, the retailer confidently handles higher sales volumes and focuses on business expansion instead of paperwork.

Billing software is a complete business management system that allows retailers to:

Generate GST-compliant invoices

Track stock automatically

Manage customers and suppliers

Monitor profit and loss

Prepare GST reports

Maintain accurate accounts

Instead of using multiple registers and spreadsheets, everything works from one integrated platform.

Modern billing software automatically calculates CGST, SGST, and IGST. It supports HSN codes, tax slabs, and GST summaries, helping retailers avoid filing mistakes.

Every sale automatically updates stock levels. Retailers can track item-wise quantity, low stock alerts, and godown-wise inventory.

Speed is crucial in retail. Billing software ensures quick invoice generation even during rush hours, improving customer experience.

Maintain customer ledgers, credit balances, supplier payments, and outstanding reports with complete clarity.

Retailers get access to:

Daily sales reports

Item-wise profit

Stock valuation

Outstanding receivables

Monthly performance analysis

These reports help in better planning and decision-making.

One of the biggest advantages of advanced billing software is integration between GST and inventory.

When billing and stock are connected:

GST returns become accurate

Stock mismatch reduces

Audit risk decreases

Business transparency improves

In 2026, GST authorities rely heavily on data consistency. Software-based billing ensures accuracy across invoices, returns, and financial records.

Retailers in Bawana Industrial Area prefer billing systems that can work even without internet. Good billing software allows:

Offline billing at counters

Online GST filing when required

Cloud access for owners who want remote monitoring

This hybrid approach gives retailers both reliability and flexibility.

Using the right billing software provides multiple long-term advantages:

Faster billing and shorter queues

Accurate GST compliance

Real-time stock visibility

Reduced manpower dependency

Better control over finances

Improved customer trust

Easy scalability as business grows

Instead of reacting to problems, retailers can proactively manage operations.

Retail businesses today are not just selling products — they are managing data, compliance, and customer experience.

In 2026, retailers upgrading their billing systems are doing so because:

GST monitoring has become stricter

Manual systems cause errors

Competition demands speed

Inventory losses impact margins

Business decisions require real-time data

Billing software is no longer an optional tool — it is a business necessity.

For retailers in Bawana Industrial Area, adopting the right billing software is one of the most important steps toward sustainable growth. A complete GST and inventory solution simplifies daily operations, improves accuracy, and removes compliance-related stress.

With automated billing, real-time stock management, and structured reporting, retailers can focus on expanding their business instead of managing paperwork. In today’s competitive environment, technology-driven billing systems are the foundation of smarter retail operations.

Location:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005, INDIA

Contact Us:

+91 7428779101

+91 9205471661

+91 8368262875

Email:

tally@binarysoft.com

Business Hours:

10:00 AM – 6:00 PM (Mon–Fri)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)