Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Call CA Tally HelpDesk +91 9205471661, 8368262875

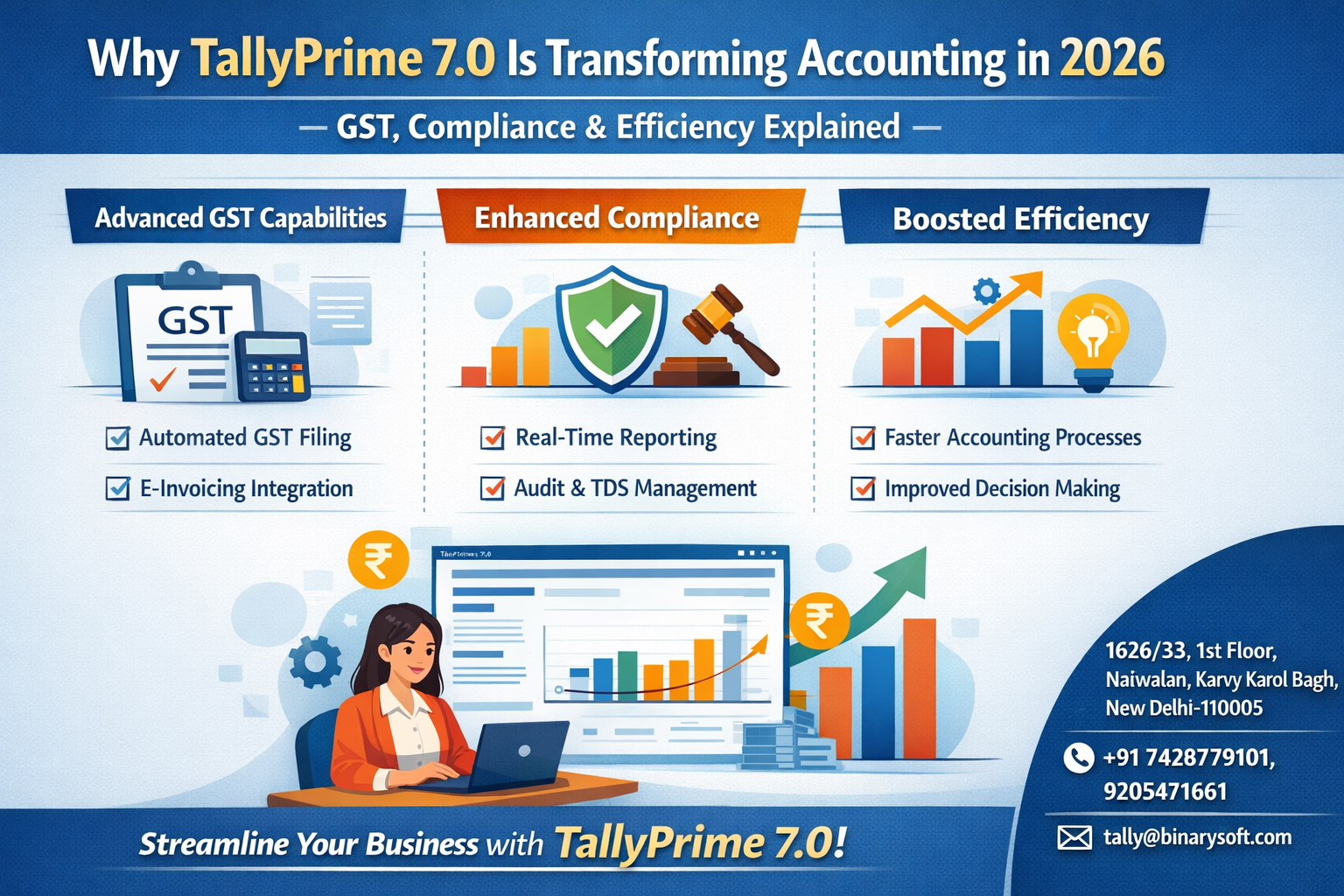

In 2026, the accounting landscape has shifted dramatically. GST authorities are leveraging deeper data matching, compliance timelines are tighter, and businesses expect real-time financial visibility instead of monthly summaries. Over recent months, the pressure on accountants has intensified — more reconciliations, more scrutiny, and less room for manual errors. Traditional workflows built around spreadsheets and fragmented tools are struggling to keep pace. This is exactly why TallyPrime 7.0 is gaining attention. It introduces smarter automation, faster data processing, and improved compliance workflows that reduce manual effort while increasing accuracy. The immediate benefit for professionals is clear: quicker GST filings, fewer notices, and the ability to handle higher workloads without burnout. For firms aiming to stay competitive in 2026, adopting smarter accounting technology is no longer a choice — it’s a necessity.

During the last financial year, a small accounting firm in North India nearly lost a key client after repeated GST mismatches caused filing delays. The team was working late nights reconciling data across systems, and morale was dropping. After moving to TallyPrime 7.0, automated reconciliation and clearer compliance reports stabilized their workflow. Deadlines became manageable again, and the client relationship was restored. The relief on the team’s faces wasn’t just about efficiency — it was about regaining confidence in their work.

Accounting today is no longer limited to recording transactions. Firms are expected to deliver insights, ensure compliance, and support business decisions — all at speed.

Key shifts shaping the profession include:

Real-time reporting expectations from clients

Increased GST scrutiny and reconciliation requirements

Higher data volumes due to digital transactions

Growing demand for advisory services

TallyPrime 7.0 is built around these realities, helping accountants transition from manual processing to intelligent financial management.

GST compliance remains one of the biggest challenges for professionals. Errors in reconciliation or classification can lead to notices and penalties.

TallyPrime 7.0 simplifies GST workflows by enabling:

Faster reconciliation with clearer mismatch visibility

Streamlined return preparation

Improved data accuracy through validation checks

These enhancements help accountants file returns with greater confidence while reducing last-minute corrections.

Compliance requirements today extend beyond tax filings. Firms must maintain accurate records, generate detailed reports, and respond quickly to audits.

TallyPrime 7.0 supports this by offering structured reporting and improved data traceability. Accountants can easily access transaction trails and compliance summaries, making audits less stressful and more efficient.

The real transformation lies in how the software reshapes everyday tasks. Automation reduces repetitive work, speeds up data processing, and minimizes manual intervention.

Routine tasks like voucher processing and report generation become faster and more accurate.

With real-time reports, accountants can provide immediate insights to clients.

By cutting down late-night reconciliations, firms can manage peak seasons without excessive stress.

In a competitive environment, efficiency alone is not enough. Firms must differentiate through better service and insights.

By freeing up time from routine tasks, TallyPrime 7.0 allows professionals to focus on:

Financial planning

Risk analysis

Business advisory

This shift elevates the role of accountants from compliance managers to strategic partners.

Technology adoption in accounting is accelerating. Firms that continue relying on outdated processes risk falling behind in both efficiency and client satisfaction.

TallyPrime 7.0 positions firms to handle future regulatory changes and increasing data complexity with confidence. Early adopters gain a clear advantage in productivity, accuracy, and client trust.

TallyPrime 7.0 represents a significant step forward in how accounting is performed in 2026. With rising compliance demands and client expectations, professionals need tools that combine speed, accuracy, and intelligence. By simplifying GST workflows, improving compliance readiness, and enhancing efficiency, TallyPrime 7.0 helps firms reduce risk, improve productivity, and deliver greater value.

For accountants looking to stay relevant in a rapidly evolving profession, embracing smarter technology is not just beneficial — it is essential for long-term success.

Powered by Binarysoft Technologies – Authorized Tally Partner

Binarysoft Technologies helps wholesale traders modernize accounting and compliance workflows with scalable solutions tailored for high-volume trade environments.

Contact:

1626/33, 1st Floor, Naiwalan, Karol Bagh, New Delhi – 110005

+91 7428779101, +91 9205471661

tally@binarysoft.com

Whether your operations are based in Bengaluru’s wholesale hubs or Chennai’s industrial parks, adopting GST-ready technology today positions your business for stronger, more predictable growth.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)