Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

By Binarysoft Editorial Team | 28-04-2025 11:50:12

In today's fast-paced business world, companies need a smart, reliable, and agile business management tool. Tally Prime is designed exactly for that — a next-generation version of the legendary Tally ERP, but with a complete... Read More

By Binarysoft Editorial Team | 01-05-2025 08:07:32

Small businesses often struggle with managing their invoicing, taxation, and financial reporting efficiently due to limited staff, budget, or time. TallyPrime’s Invoice Management System (IMS) offers a powerful, user-friendly solution that auto... Read More

By Binarysoft Editorial Team | 09-05-2025 10:16:43

Tally Prime, the latest version of Tally accounting software, offers robust features for businesses engaged in manufacturing, processing, or project-based operations. Two important features in Tally Prime are Job Work and Job Costing, which allo... Read More

By Binarysoft Editorial Team | 26-05-2025 10:22:15

Tally Prime is one of the most widely used accounting and business management software in India and many other countries. Its simplicity, flexibility, and strong features make it a favorite among small and medium businesses. But what truly sets Tally... Read More

By Binarysoft Editorial Team | 30-05-2025 05:33:33

In today's globalized business landscape, dealing with multiple currencies is common for companies engaged in international trade. TallyPrime, a powerful business accounting software by Tally Solutions, provides robust support for multi-currency ... Read More

By Binarysoft Editorial Team | 30-05-2025 06:50:27

With the introduction of stricter tax regulations and digital tax compliance, Tax Collected at Source (TCS) has become a vital part of many business transactions in India. TallyPrime, a leading accounting software, simplifies the process of mana... Read More

By Binarysoft Editorial Team | 05-06-2025 10:17:12

Tally (especially TallyPrime) has evolved significantly to comply with the GST regime in India. Understanding the distinction between B2B (Business-to-Business) and B2C (Business-to-Consumer) is crucial for accurate invoicing, taxation, and... Read More

By Binarysoft Editorial Team | 06-06-2025 09:28:16

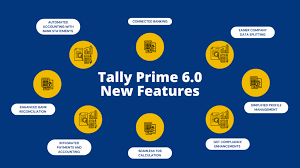

In the fast-evolving landscape of accounting and business management software, Tally Prime stands as one of the most trusted and widely used platforms in India and abroad. To ensure continued efficiency, compliance with legal requirements, and access... Read More

By Binarysoft Editorial Team | 14-07-2025 17:25:54

TallyPrime 6.1 is a powerful upgrade in the Tally accounting software line, designed to meet evolving business needs with a focus on compliance, ease of use, and integration with government portals such as the GST and e-Invoice systems. As businesses... Read More

By Binarysoft Editorial Team | 14-07-2025 07:50:45

TallyPrime has long been a trusted accounting and business management solution for millions of Indian businesses. With the release of TallyPrime 6.1, the software takes a major step forward in areas of GST compliance, invoice reconciliation, audit tr... Read More

By Binarysoft Editorial Team | 16-07-2025 07:03:15

TallyPrime 6.1 is one of the latest and most advanced versions of Tally’s accounting software, designed to offer simplified, faster, and more powerful business management solutions. It builds upon the strengths of earlier versions like Tally ER... Read More

By Binarysoft Editorial Team | 18-07-2025 05:59:23

TallyPrime, developed by Tally Solutions Pvt. Ltd., is among the most popular and reliable business accounting software in India and several other countries. Its reputation is built on decades of consistent performance, legal compliance features, and... Read More

By Binarysoft Editorial Team | 29-07-2025 13:41:31

TallyPrime is widely known for its core strength — simple, reliable, and robust accounting. However, in today’s fast-moving business environment, companies need more than just ledgers and vouchers. They need integration, automation, and f... Read More

By Binarysoft Editorial Team | 31-07-2025 12:10:39

In today’s competitive business environment, managing finances efficiently is more than just a necessity—it’s a strategic advantage. Accounting software plays a crucial role in helping businesses maintain financial records, manage t... Read More

By Binarysoft Editorial Team | 07-08-2025 06:37:51

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy. To ensure timely payments to MSMEs, the Ministry of Corporate Affairs (MCA) introduced MSME Form 1, making it mandatory for companies to report all outstanding dues ... Read More

By Binarysoft Editorial Team | 07-08-2025 06:39:25

In the ever-evolving landscape of accounting and compliance, Chartered Accountants (CAs) play a crucial role in managing financial data, audits, taxation, and statutory reporting for businesses of all sizes. With increasing regulations and deadl... Read More

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)