Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com 10:00 am – 6: 00 pm , Mon-Fri

By CA, Rishubh Talrejaa | 05-02-2026 14:00:00

In recent months, businesses across Delhi’s industrial belts have faced rising raw-material prices, tighter GST scrutiny, unpredictable supply chains, and customers demanding faster deliveries with zero excuses. In hubs like Jhandewalan Industr... Read More

By CA. Shivesh Khandelwaal | 05-02-2026 12:00:00

In 2026, the jewellery business in Delhi is facing a reality shift. Over the past few months, GST scrutiny has increased, hallmark transparency expectations have tightened, and customers have become far more aware of pricing, purity, and billing accu... Read More

By CA. Shivesh Khandelwaal | 05-02-2026 10:00:00

In 2026, small businesses across India are facing a new kind of pressure. Over the past few months, GST rules have tightened, compliance timelines have shortened, and customers now expect faster invoices and transparent records. What once worked with... Read More

By CA. Praneet Bansaal | 04-02-2026 15:30:00

In 2026, the way businesses manage accounts is changing faster than ever. With rising compliance pressure, real-time reporting expectations, tighter GST scrutiny, and increasing cybersecurity risks, outdated accounting systems are no longer just inef... Read More

By CA. Sagar Singh | 04-02-2026 14:30:00

The garment trade in Bengaluru is entering a decisive digital phase in 2026. With GST systems becoming more automated, compliance checks growing sharper, and retailers demanding faster service, traditional billing methods are rapidly losing relevance... Read More

By CA. Rohin Mehtaal | 04-02-2026 13:30:00

India’s garment wholesale sector is undergoing a silent but powerful transformation in 2026. With faster fashion cycles, unpredictable demand patterns, tighter GST scrutiny, and rising competition from digitally enabled distributors, traditiona... Read More

By CA. Anand Tirpathi | 04-02-2026 12:30:00

Wholesale trading in Mumbai is evolving rapidly in 2026. With tighter GST scrutiny, expanding e-invoicing mandates, faster logistics cycles, and increasing competition from organized distributors, traders can no longer afford operational blind spots.... Read More

By CA. Sagar Singh | 04-02-2026 11:30:00

Wholesale trading across India’s largest commercial hubs has entered a new digital era in 2026. With GST enforcement becoming more data-driven, e-invoicing thresholds expanding, and buyers expecting instant billing, traditional handwritten invo... Read More

By CA. Rohin Mehtaal | 04-02-2026 10:30:00

Wholesale trading in India is undergoing a rapid digital shift in 2026. With stricter GST reconciliation, faster e-invoicing adoption, rising compliance checks, and increasing competition from organized supply chains, traditional stock registers and ... Read More

By CA. Mayankh Singhaal | 03-02-2026 17:30:00

What changed in 2026 for retail stores? Customer behavior has evolved rapidly—buyers now expect instant checkout, digital payment options, accurate billing, and seamless return handling. At the same time, retailers are facing tighter GST scruti... Read More

By CA. Ankit Vardiya | 03-02-2026 16:30:00

What changed in 2026 for supermarkets? Customer expectations have never been higher. Shoppers now demand lightning-fast checkout, digital payment options, accurate billing, and real-time product availability. Meanwhile, supermarket owners face growin... Read More

By CA. Shivesh Khandelwaal | 03-02-2026 15:30:00

What changed in 2026 for accounting teams? Businesses are handling higher transaction volumes than ever before, compliance timelines are tighter, and leadership expects real-time financial visibility. Yet many companies still rely on Excel for mainta... Read More

By CA. T.R Venkat | 03-02-2026 14:30:00

What changed in 2026 for Tally users? In recent months, businesses have become more dependent than ever on uninterrupted accounting systems as GST scrutiny tightens, compliance timelines shrink, and digital audits become more common. A single expired... Read More

By CA. Darshit Malhotraa | 03-02-2026 13:30:00

What changed in 2026 for Tally users? Cyber threats are rising, hardware failures are more frequent than most businesses expect, and compliance-driven audits now demand instant access to financial data. In recent months, many businesses have learned ... Read More

By CA. Arvindh Khetwaani | 03-02-2026 12:30:00

This shift has made advanced accounting software a necessity rather than an upgrade. In 2026, modern accounting systems combine automation, security, compliance, and scalability into one intelligent platform. The benefit is immediate and measurable: ... Read More

By CA. Mayankh Singhaal | 03-02-2026 11:30:00

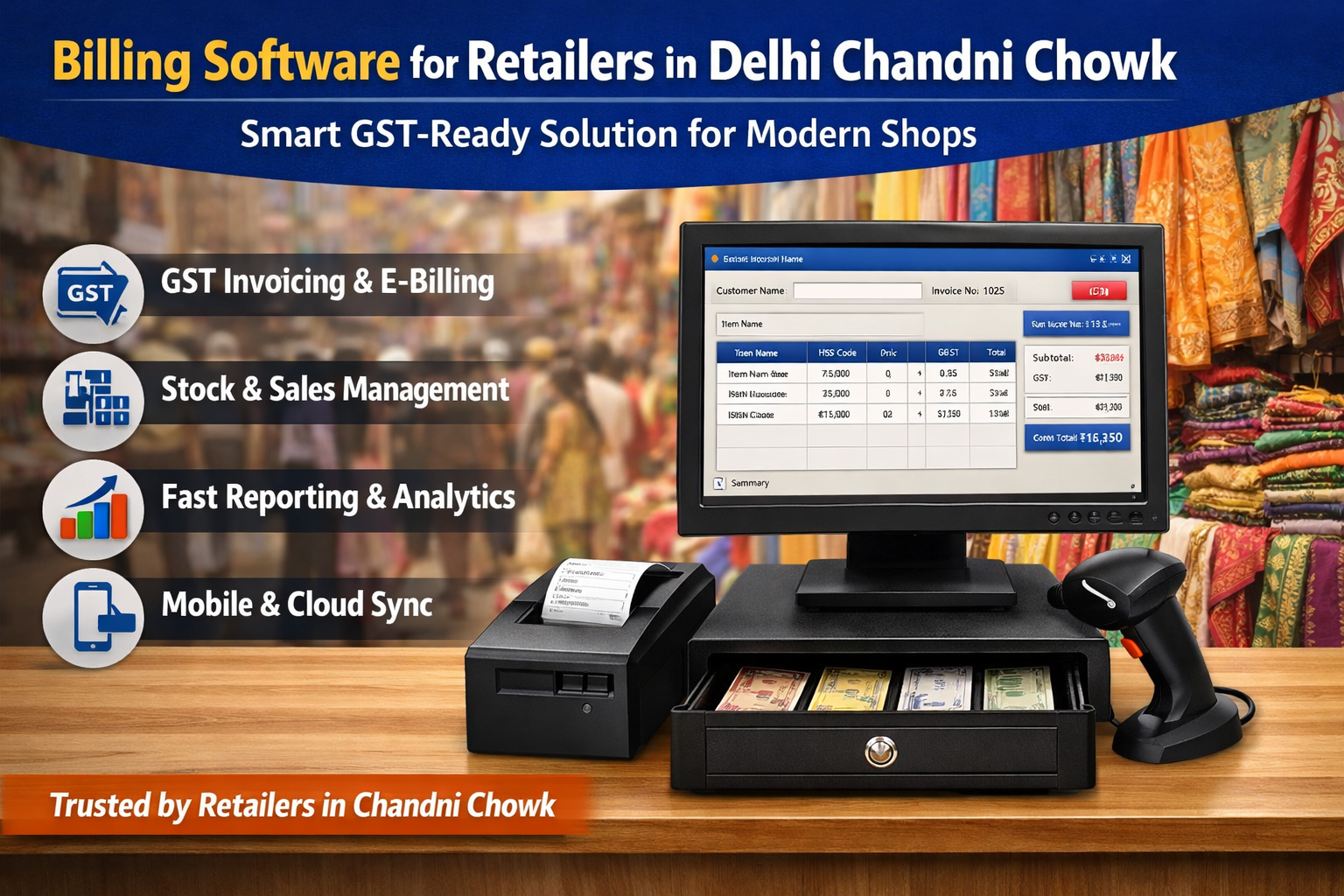

In recent months, retail shopkeepers across Chandni Chowk, Karol Bagh, Sadar Bazaar, Lajpat Nagar, and other busy Delhi markets are facing new pressure from all sides. GST compliance has become stricter, customers expect instant bills and UPI payment... Read More

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)